Over the past century, Marxism has been radically transformed in line with circumstances and fashion. Theses that once looked solid have depreciated and fallen by the sideline; concepts that once were deemed crucial have been abandoned; slogans that once sounded clear and meaningful have become fuzzy and ineffectual.

But two key words seem to have survived the attrition and withstood the test of time: imperialism and financialism. ((The precise terms are rather loose and their use varies across theorists and over time. Imperialism, empire and colonialism are used interchangeably, as are finance, fictitious capital finance capital, financialization and financialism. Here we use imperialism and financialism simply because they rhyme.))

Talk of imperialism and financialism – and particularly of the nexus between them – remains as catchy as ever. Marxists of different colours – from classical, to neo to post – find the two terms expedient, if not indispensable. Radical anarchists, conservative Stalinists and distinguished academics of various denominations all continue to use and debate them.

The views of course differ greatly, but there is a common thread: for most Marxists, imperialism and financialism are prime causes of our worldly ills. Their nexus is said to explain capitalist development and underdevelopment; it underlies capitalist power and contradictions; and it drives capitalist globalization, its regional realignment and local dynamics. It is a fit-all logo for street demonstrators and a generic battle cry for armchair analysts.

The secret behind this staying power is flexibility. Over the years, the concepts of imperialism and financialism have changed more or less beyond recognition, as a result of which the link between them nowadays connotes something totally different from what it meant a century ago.

The purpose of this article is to outline this chameleon-like transformation, to assess what is left of the nexus and to ask whether this nexus is still worth keeping.

Empire and Finance

The twin notions of imperialism and financialism emerged at the turn of the twentieth century. The backdrop is familiar enough. During the latter part of the nineteenth century, the leading European powers were busy taking over large tracts of non-capitalist territory around the world. At the same time, their own political economies were being fundamentally transformed. Since the two developments unfolded hand in hand, it was only natural for theorists to ask whether they were related – and if so, how and why.

The most influential explanation came from a British left liberal, John Hobson, whose work on the subject was later extended and modified by Marxists such as Rosa Luxemburg, Rudolf Hilferding, Vladimir Lenin and Karl Kautsky, among others. ((John. A. Hobson, Imperialism: A Study (Ann Arbor: University of Michigan Press, 1902 [1965]); Rosa Luxemburg, The Accumulation of Capital, with an introduction by Joan Robinson, translated by A. Schwarzschild (New Haven: Yale University Press, 1913 [1951]); Rudolf Hilferding, Finance Capital: A Study of the Latest Phase of Capitalist Development, edited with an introduction by Tom Bottomore, from a translation by Morris Watnick and Sam Gordon (London: Routledge & Kegan Paul, 1910 [1981]); Vladimir I. Lenin, ‘Imperialism, The Highest State of Capitalism’, in Essential Works of Lenin. ‘What Is to Be Done?’ and Other Writings (New York: Dover Publications, Inc., 1917 [1987]), p. 177-270; Karl Kautsky, ‘Ultra-Imperialism’, New Left Review, 1970, No. 59 (Jan/Feb), p. 41-46 (original German version published in 1914).))

Framed in a nutshell, the basic argument rested on the belief that capitalism had changed: originally ‘industrial’ and ‘competitive’, the system had become ‘financial’ and ‘monopolistic’.

This transformation, said the theorists, had two crucial effects. First, the process of monopolization and the centralization of capital in the hands of the large financiers made the distribution of income far more unequal, and that greater inequality restricted the purchasing power of workers relative to the productive potential of the system. As a result of this imbalance, there emerged the spectre of ‘surplus capital’, excess funds that could not be invested profitably in the home market. And since this ‘surplus capital’ could not be disposed of domestically, it forced capitalists to look for foreign outlets, particularly in pristine, pre-capitalist regions.

Second, the centralization of capital altered the political landscape. Instead of the night-watchman government of the laissez-faire epoch, there emerged a strong, active state. The laissez-faire capitalists of the earlier era saw little reason to share their profits with the state and therefore glorified the frugality of a small central administration and minimal taxation. But the new state was no longer run by hands-off liberals. Instead, it was dominated and manipulated by an aggressive oligarchy of ‘finance capital’ – a coalition of large bankers, leading industrialists, war mongers and speculators who needed a strong state that would crack down on domestic opposition and embark on foreign military adventures.

And so emerged the nexus between imperialism and financialism. The concentrated financialized economy, went the argument, requires pre-capitalist colonies where surplus capital can be invested profitably; and the cabal of finance capital, now in the political driver’s seat, is able to push the state into an international imperialist struggle to obtain those colonies.

At the time, this thesis was not only totally new and highly sophisticated; it also fit closely with the unfolding of events. It gave an elegant explanation for the imperial bellicosity of the late nineteenth century, and it neatly accounted for the circumstances leading to the great imperial conflict of the first ‘World War’. There were of course other explanations for that war – from realist/statist, to liberal, to geopolitical, to psychological. ((See, for example, Joseph A. Schumpeter, Imperialism and Social Classes, with an introduction by Bert Hoselitz, translated by Heinz Norden (New York: Meridian Books, 1919; 1927 [1955]); Barbara Wertheim Tuchman, The Guns of August (New York: Macmillan, 1962) and The Proud Tower: A Portrait of the World Before the War, 1890-1914 (New York: Macmillan, 1966); and Paul M. Kennedy, The Rise and Fall of the Great Powers (New York: Random House, 1987), Ch. 5.)) But for most intellectuals, these alternative explications seemed too partial or instrumental compared to the sweeping inevitability offered by the nexus of empire and finance.

History, though, kept changing, and soon enough both the theory and its basic concepts had to be altered.

Monopoly Capital

The end of the Second World War brought three major transformations. First, the nature of international conflict changed completely. Instead of a violent inter-capitalist struggle, there emerged a Cold War between the former imperial powers on the one hand and the (very imperial) Soviet bloc on the other (with plenty of hot proxy conflicts flaring up in the outlying areas). Second, the relationship between core and periphery was radically altered. Outright conquest and territorial imperialism gave way to decolonization, while tax-collecting navies were replaced by the more sophisticated tools of foreign aid and foreign direct investment (FDI). Third and finally, the political economies of the core countries themselves were reorganized. Instead of the volatile laissez-faire regime, there arose a large welfare-warfare state whose ‘interventionist’ ideologies and counter-cyclical policies managed to reduce instability and boost domestic growth.

On the face of it, this new constellation made talk of finance-driven imperialism seem outdated if not totally irrelevant. But the theorists didn’t give up the nexus. Instead, they gave it a new meaning.

The revised link was articulated most fully by the Monopoly Capital School associated with the New York journal Monthly Review. ((Some of the important contributions to this literature include Josef Steindl, Maturity and Stagnation in American Capitalism (New York: Monthly Review Press, 1952 [1976]); Shigeto Tsuru, ‘Has Capitalism Changed?’ in Has Capitalism Changed? An International Symposium on the Nature of Contemporary Capitalism, edited by S. Tsuru (Tokyo: Iwanami Shoten, 1956), p. 1-66. Paul A. Baran and Paul M. Sweezy, Monopoly Capital: An Essay on the American Economic and Social Order (New York: Modern Reader Paperbacks, 1966); and Harry Magdoff, The Age of Imperialism: The Economics of U.S. Foreign Policy, 1st Modern Reader ed. (New York: Monthly Review Press, 1969).)) Capitalism, argued the writers of this school, remains haunted by a lack of profitable investment outlets. And that problem, along with its solution, can no longer be explained in classical Marxist terms.

The shift from competition to oligopoly that began in the late nineteenth century, these writers claimed, was now complete. And that shift meant that Marx’s ‘labour theory of value’ and his notion of ‘surplus value’ had become more or less irrelevant to capitalist pricing.

In the brave new world of oligopolies, the emphasis on non-price competition speeds up the pace of technical change and efficiency gains, making commodities cheaper and cheaper to produce. But unlike in a competitive system, these rapid cost reductions do not translate into falling prices. The prevalence of oligopolies creates a built-in inflationary bias which, despite falling costs, makes prices move up and sometimes sideways, but rarely if ever down.

This growing divergence between falling costs and rising prices increases the income share of capitalists, and that increase reverses the underlying course of capitalism. Marx believed that the combination of ever-growing mechanization and ruthless competition creates a ‘tendency of the rate of profit to fall’. But the substitution of monopoly capitalism for free competition inverts the trajectory. The new system is ruled by an opposite ‘tendency of the surplus to rise’.

The early theorists of imperialism, although using a different vocabulary, understood the gist of this transformation. And even though they did not provide a full theory to explain it, they realized that the consequence of that transformation was to shift the problem of capitalism from production to circulation (or in later Keynesian parlance, from ‘aggregate supply’ to ‘aggregate demand’). The new capitalism, they pointed out, suffered not from insufficient surplus, but from too much surplus, and its key challenge now was how to ‘offset’ and ‘absorb’ this ever-growing excess so that accumulation could keep going instead of coming to a halt.

That much was already understood at the turn of the twentieth century. But this is where the similarity between the early theorists of imperialism and the new analysts of Monopoly Capital ends.

Black Hole: The Role of Institutionalized Waste

Until the early twentieth century, it seemed that the only way to offset the growing excess was productive and external: the surplus of goods and capital had to be exported to and invested in pre-capitalist colonies. But as it turned out, there was another solution, one that the early theorists hadn’t foreseen and that the analysts of Monopoly Capital now emphasized. The surplus could also be disposed off unproductively and internally: it could be wasted at home.

For the theorists of Monopoly Capital, ‘waste’ denoted expenditures that are necessary neither for producing the surplus nor for reproducing the population, and that are, in that sense, totally unproductive and therefore wasteful. These expenditures absorb existing surplus without ever creating any new surplus, and this double feature enables them to mitigate without ever aggravating the ‘tendency of the surplus to rise’.

The absorptive role of wasteful spending wasn’t entirely new, having already been identified at the turn of the twentieth century by Thorstein Veblen. ((Veblen’s early analysis is articulated in The Theory of Business Enterprise (Clifton, New Jersey: Augustus M. Kelley, Reprints of Economics Classics, 1904 [1975]).)) But it was only after the Second Word War, with the entrenchment of the Fordist model of mass production and consumption and the parallel rise of the welfare-warfare state, that the process was fully and conscientiously institutionalized as a salient feature of monopoly capitalism.

By the end of the war, the U.S. ruling class grew fearful that demobilization would trigger another severe depression; and having accepted and internalized the stimulating role of large-scale government spending, it supported the creation of a new ‘Keynesian Coalition’ that brought together the interests of big business, the large labour unions and various state agencies. The hallmark of this coalition was immortalized in a secret U.S. National Security Council document (NSC-62), whose writers explicitly called on the government to use high military spending as a way of securing the internal stability of U.S. capitalism. ((See U.S. National Security Council, NSC 68: United States Objectives and Programs for National Security. A Report to the President Pursuant to the President’s Directive of January 31, 1950. Top Secret (Washington DC, 1950); David A. Gold, ‘The Rise and Fall of the Keynesian Coalition’, Kapitalistate, 1977, Vol. 6, No. 1, p. 129-161; and Jonathan Nitzan and Shimshon Bichler, ‘Cheap Wars’, Tikkun, August 9, 2006.))

According to its theorists, monopoly capitalism gave rise to many forms of institutionalized waste – including a bloated sales effort, the creation of new ‘desires’ for useless goods and services and the acceleration of product obsolescence, among other strategies. But the two most significant types of waste were spending on the military and on the financial sector.

The importance of these latter expenditures, went the argument, lies in their seemingly limitless size. The magnitude of military expenditures has no obvious ceiling: it depends solely on the ability of the ruling class to justify the expenditures on grounds of national security. Similarly with the size of the financial sector: its magnitude expands with the potentially limitless inflation of credit. This convenient expandability turns military spending and financial intermediation into a giant ‘black hole’ (our term): they suck in large chunks of the excess surplus without ever generating any excess surplus of their own. ((Classical Marxists interpret the role of waste rather differently. In their account, wasteful spending withdraws surplus from the accumulation process; this withdrawal reduces the pace at which constant capital accumulates; and that reduction lessens the tendency of the rate of profit to fall. See for example Michael Kidron, Capitalism and Theory (London: Pluto Press, 1974).))

Now, on the face of it, the efficacy of this domestic black hole should have made imperialism less necessary if not wholly redundant. According to the theorists of Monopoly Capital, though, this would be the wrong conclusion to draw. It is certainly true that, unlike the old imperial system, monopoly capitalism no longer needs colonies. But the absence of formal colonies is largely a matter of appearance. Remove this appearance and you’ll see the imperial impulse pretty much intact: the core continues to exploit, dominate and violate the periphery for its own capitalist ends. ((Perhaps the clearest advocate of this argument was the late Harry Magdoff, a writer whose empirical and theoretical studies stand as a beacon of scientific research; for a summary, see his Imperialism Without Colonies (New York: Monthly Review Press, 2003). Similar claims (minus the research) are offered by Ellen Meiksins Wood, Empire of Capital (London and New York: Verso, 2003).))

Spearheaded by U.S.-based multinationals and no longer hindered by inter-capitalist wars, argued the theorists, the new order of monopoly capitalism has become increasingly global and ever more integrated. And this global integration, they continued, has come to depend on an international division of labour, free access to strategic raw materials and political regimes that are ideologically open for business. However, these conditions do not develop automatically and peacefully. They have to be actively promoted and enforced – often against stiff domestic opposition – and they have to be safeguarded against external threats (the Soviet bloc before its collapse, Islamic fundamentalism and rogue states since then, etc.). And because such promotion and enforcement hinge on the threat and frequent use of violence, there is an obvious justification if not outright need for a large, well-equipped army sustained by large military budgets.

In this context, military spending comes to serve a dual role: together with the financial sector and other forms of waste, it propels the accumulation of capital by black-holing a large chunk of the economic surplus; and it helps secure a more sophisticated and effective neo-imperial order that no longer needs colonial territories but is every bit as expansionary, exploitative and violent as its crude imperial predecessor.

Dependency

The notion of neo-imperialism boosted and gave credence to a subsidiary theory of dependency. ((Some of the important texts here include Raúl Prebisch, The Economic Development of Latin America and its Principal Problems (New York: United Nations, 1950); Paul A. Baran, The Political Economy of Growth (New York and London: Modern Reader Paperbacks, 1957); Andre Gunder Frank, Capitalism and Underdevelopment in Latin America: Historical studies of Chile and Brazil (New York: Monthly Review Press, 1967); Arghiri Emmanuel, Unequal Exchange. A Study of the Imperialism of Trade (New York: Monthly Review Press, 1972); Eduardo H. Galeano, Open Veins of Latin America: Five Centuries of the Pillage of a Continent (New York: Monthly Review Press, 1973). Samir Amin, Accumulation on a World Scale: A Critique of the Theory of Underdevelopment. 2 vols. (New York: Monthly Review Press. 1974); Immanuel Maurice Wallerstein, The Modern World-System. Capitalist Agriculture and the Origins of the European World-Economy in the Sixteenth Century (New York: Academic Press, 1974) and The Modern World-System II: Mercantilism and the Consolidation of the European World-Economy, 1600-1750 (New York: Academic Press, 1980); and Fernando Henrique Cardoso and Enzo Faletto, Dependency and Development in Latin America (Berkeley: University of California Press, 1979).)) This support was somewhat paradoxical, since the lineage between the two theories was weak if not contradictory. Recall that, by emphasizing the role of domestic waste, the theory of Monopoly Capital served to deemphasize if not totally negate the absorptive importance of the periphery. But the analysts of dependency put their own emphasis elsewhere. The persistence of (neo) imperialism, they claimed, showed that, regardless of its own internal dynamics, the core still needs to keep the periphery chronically subjugated and underdeveloped.

This dependency, went the argument, is the outcome of five hundred years of colonial destruction. During that period, the imperial powers systematically undermined the socio-economic fabric of the periphery, making it totally dependent on the core. In this way, when decolonization finally started, the periphery found itself unable to take off while the capitalist core prospered. There was no longer any need for core states to openly colonize and export capital to the periphery. Using their disproportionate economic and state power, the former imperialist countries were now able to hold the postcolonial periphery in a state of debilitating economic monoculture, political submissiveness and cultural backwardness – and, wherever they could, to impose on it a system of unequal exchange.

Unequal exchange can take different forms. It may involve a wage gap between the ‘less exploited’ labour aristocracy of the core and the ‘more exploited’ simple labour of the periphery. Or the core can compel the periphery to buy its exports at ‘high’ prices (relative to their ‘true’ value), while importing the periphery’s products at ‘low’ prices (relative to their ‘true’ value). As a result of this latter difference, the terms of trade get ‘distorted’, surplus is constantly siphoned into the core (rather than exported from or domestically absorbed by the core), and the eviscerated periphery remains chronically underdeveloped. ((The inverted commas in this paragraph highlight concepts that the theory of unequal exchange can neither define nor measure. Since nobody knows the correct value of labour power, it is impossible to determine the extent of ‘exploitation’ in the two regions. Similarly, since no one knows the ‘true’ value of commodities, there is no way to assess the extent to which export and import prices are ‘high’ or ‘low’. This latter ignorance makes it impossible to gauge the degree to which the terms of trade are ‘distorted’ and, indeed, in whose favour; and given that we don’t know the magnitude or even the direction of the ‘distortion’, it is impossible to tell whether surplus flows from the periphery to the core or vice versa, and how large the flow might be.))

This logic of dependent underdevelopment was first articulated during the 1950s and 1960s as an antidote to the liberal modernization thesis and its Rostowian promise of an imminent takeoff. ((W.W. Rostow, The Stages of Economic Growth: A Non-Communist Manifesto (Cambridge, England: Cambridge University Press, 1960).)) And at the time, that antidote certainly seemed to be in line with the chronic stagnation of peripheral countries.

But what started as a partial theory soon expanded into a sweeping history of world capitalism. According to this broader narrative, capitalism was and remained imperial from the word go: it didn’t simply start with conquest; it started because of conquest. Its very inception was predicated on geographical exploitation and domination – a process in which the financial-commercial metropolis (say England) used the surplus extracted from a productive periphery (say India) to kick-start its own economic growth. And once started, the only way for this growth to be sustained is for the metropolis to continue to eviscerate the periphery around it. The development of the emperor depends on and necessitates the underdevelopment of its subjects.

The next theoretical step was to fit this template into an even broader concept of a World System – an all-encompassing global approach that seeks to map the hierarchical political relationships, division of labour and flow of commodities and surplus between the peripheral countries at the bottom, the semi-peripheral satellites in the middle and the financial core at the apex. From the viewpoint of this larger retrofit, capitalism is no longer the outcome of a specific class struggle, a conflict that developed in Western Europe during the twilight of feudalism and later spread to and reproduced itself in the rest of the world. Instead, capitalism – to the extent that this term can still be meaningfully used – is merely the outer appearance of Europe’s imperial expedition to rob and loot the rest of the world.

This view reflected a fundamental change in emphasis. Whereas earlier Marxist theorists of imperialism accentuated the centrality of exploitation in production, dependency and World System analysts shifted the focus to trade and unequal exchange. And while previous theories concentrated on the global class struggle, dependency and World System analyses spoke of a conflict between states and geographical regions. The new framework, although nominally ‘Marxist’ on the outside, has little Marxism left on the inside. ((The question of what constitutes a ‘proper’ Marxist framework is highlighted in the debates over the transition from feudalism to capitalism. Important contributions to these debates are Maurice Dobb, Studies in the Development of Capitalism. London: Routledge & Kegan Paul Ltd., 1946. [1963]); Paul M. Sweezy ‘A Critique’, in The Transition from Feudalism to Capitalism, Introduction by Rodney Hilton, edited by R. Hilton (London: Verso, 1950 [1978]); Robert Brenner, ‘The Origins of Capitalist Development: A Critique of Neo-Smithian Marxism’, New Left Review, 1977, No. 104 (July-August), p. 25-92; and Robert Brenner, ‘Dobb on the Transition from Feudalism to Capitalism’, Cambridge Journal of Economics, 1978, Vol. 2, No. 2 (June), p. 121-140. For edited volumes on this issue, see Rodney Hilton, ed., The Transition from Feudalism to Capitalism, Introduction by Rodney Hilton (London: Verso, 1978); and T. H. Aston and C. H. E. Philpin, eds., The Brenner Debate: Agrarian Class Structure and Economic Development in Pre-Industrial Europe (Cambridge and New York: Cambridge University Press, 1985).))

And if we are to believe the postists who quickly jumped on the dependency bandwagon, there is nothing particularly surprising about this particular theoretical bent. After all, ‘history’ is no more than an ethno-cultural clash of civilizations, a never-ending cycle of imperial ‘hegemonies’ in which the winners (ego) impose their ‘culture’ on the losers (alter). ((For a typical narrative, see John M. Hobson, The Eastern Origins of Western Civilisation. (Cambridge, UK and New York: Cambridge University Press. 2004).)) To the naked eye, the totalizing capitalization of our contemporary world may seem like a unique historical process. But don’t be deceived. This apparent uniqueness is a flash in the pan. Deconstruct it and what you are left with is yet another imperial imposition – in this case, the imposition of a Euro-American ‘financialized discourse’ on the rest of the world.

Red Giant: An Empire Imploded

The dependency version of the nexus, though, didn’t hold for long, and in the 1970s the cards again got shuffled. The core stumbled into a multifaceted crisis: the United States suffered a humiliating defeat in Vietnam, stagflation decelerated and destabilized the major capitalist countries and political unrest seemed to undermine the legitimacy of the capitalist regime itself. In the meantime, the periphery confounded the theorists: on the one hand, import substitution, the prescribed antidote to dependency, pushed developing countries, primarily in Latin America, into a debt trap; on the other hand, the inverse policy of privatization and export promotion, implemented mostly in East Asia, triggered an apparent ‘economic miracle’. Taken together, these developments didn’t seem to sit well with the notion of Western financial imperialism. And so, once more the nexus had to be revised.

According to the new script, ‘financialization’ is no longer a panacea for the imperial power. In fact, it is prime evidence of imperial decline.

The reasoning here goes back to the basic Marxist distinction between ‘industrial’ activity on the one hand and ‘commercial’ and ‘financial’ activities on the other. The former activity is considered ‘productive’ in that it generates surplus value and leads to the accumulation of ‘actual’ capital. The latter activities, by contrast, are deemed ‘unproductive’; they don’t generate any new surplus value and therefore, in and of themselves, do not create any ‘actual’ capital.

This distinction – which most Marxists accept as sacrosanct – has important implications for the nexus of imperialism and financialism. It is true, say the advocates of the new script, that finance (along with other forms of waste) helps the imperial core absorb its rising surplus – and in so doing prevents stagnation and keeps accumulation going. But there is a price to pay. The addiction to financial waste ends up consuming the very fuel that sustains the core’s imperial position: it hollows out the core’s industrial sector, it undermines its productive vitality, and, eventually, it limits its military capabilities. The financial sector itself continues to expand absolutely and relatively, but this is the expansion of a ‘red giant’ (our term) – the final inflation of a star ready to implode.

The process leading to this implosion is emphasized by theories of hegemonic transition. ((See for example, Fernand Braudel, Civilization & Capitalism, 15th-18th Century, translated from the French and revised by Sian Reynolds, 3 vols. (New York: Harper & Row, Publishers, 1985); Immanuel Maurice Wallerstein, The Politics of the World-Economy: The States, the Movements, and the Civilizations (Cambridge, New York and Paris: Cambridge University Press and Editions de la Maison des sciences de l’homme, 1984); and Giovanni Arrighi, The Long Twentieth Century: Money, Power, and the Origins of Our Times. London: Verso, 1994.)) The analyses here come in different versions, but they all seem to agree on the same basic template. According to this template, the maturation of a hegemonic power – be it Holland in the seventeenth century, Britain in the nineteenth century or the United States presently – coincides with the ‘over-accumulation’ of capital (i.e. the absence of sufficiently profitable investment outlets). This over-accumulation – along with growing international rivalries, challenges and conflicts – triggers a system-wide financial expansion, marked by soaring capital flows, a rise in market speculation and a general inflation of debt and equity values. The financial expansion itself is led by the hegemonic state in an attempt to arrest its own decline, but the reprieve it offers can only be temporary. Relying on finance drains the core of its energy, causes productive investment to flow elsewhere and eventually sets in motion the imminent process of hegemonic transition.

Although the narrative here is universal, its inspiration is clearly drawn from the apparent ‘financialized decline’ of U.S. hegemony. Since the 1970s, many argue, the country has been ‘depleted’: it has grown overburdened by military spending; it has gotten itself entangled in unwinnable armed conflicts, and it has witnessed its industrial-productive base sucked dry by a Wall Street-Washington Complex that prospers on the back of rising debt and bloated financial intermediation. ((For the ‘depletion thesis’, see for example Seymour Melman, Pentagon Capitalism: The Political Economy of War, 1st ed. (New York: McGraw-Hill, 1970) and The Permanent War Economy: American Capitalism in Decline (New York: Simon and Schuster, 1974). A broader historical application is given in Paul M. Kennedy, The Rise and Fall of the Great Powers (New York, NY: Random House: 1987).))

In order to compensate for its growing weakness, these observers continue, the United States has imposed its own model of ‘financialization’ on the rest of the world, hoping to scoop the resulting expansion of liquidity. Some states have been compelled to replicate the model in their own countries, others states have been tempted to finance it by buying U.S. assets, and pretty much all states have been pulled into an unprecedented global whirlpool of capital flow.

The spread of ‘financialization’, though, has only been party successful. For a while, the United States benefited from being able to control, manipulate and leverage this expansion for its own ends. But in the opinion of many, the growing severity of recent financial, economic and military crises suggests that this ability has been greatly reduced and that U.S. hegemony is now coming to an end.

Capital Flow and Transnational Ownership

The highly publicized nature of these imperial misgivings makes this latest version of the nexus seems persuasive. But when we look more closely at the facts, the theoretical surface no longer seems smooth; and as we get even closer to the evidence, cracks begin to appear.

Start with the cross-border flow of capital, the international manifestation of ‘financialization’. This process is often misunderstood, even by high theorists, so a brief clarification is in order. Contrary to popular belief, the flow of capital is financial, and only financial. It consists of legal transactions, whereby investors in one country buy or sell assets in another – and that is it. There is no flow of material or immaterial resources, productive or otherwise. The only things that move are ownership titles. ((The generalization here applies to portfolio as well as direct foreign investment. Both are financial transactions, pure and simple. The only difference between them is their relative size: typically, investments that account for less than 10% of the acquired property are considered portfolio, whereas larger investments are classified as direct. The flow of capital, whether portfolio or direct, may or may not be followed by the creation of new productive capacity. But the creation of such capacity, if and when it happens, is conceptually distinct, temporally separate and causally independent from the mere act of foreign investment.))

These changes in ownership, of course, are of great importance. If the flow of capital is large enough, the stock of foreign owned assets will grow relative to domestically owned assets. And as the ratio rises, the ownership of capital becomes increasingly transnational.

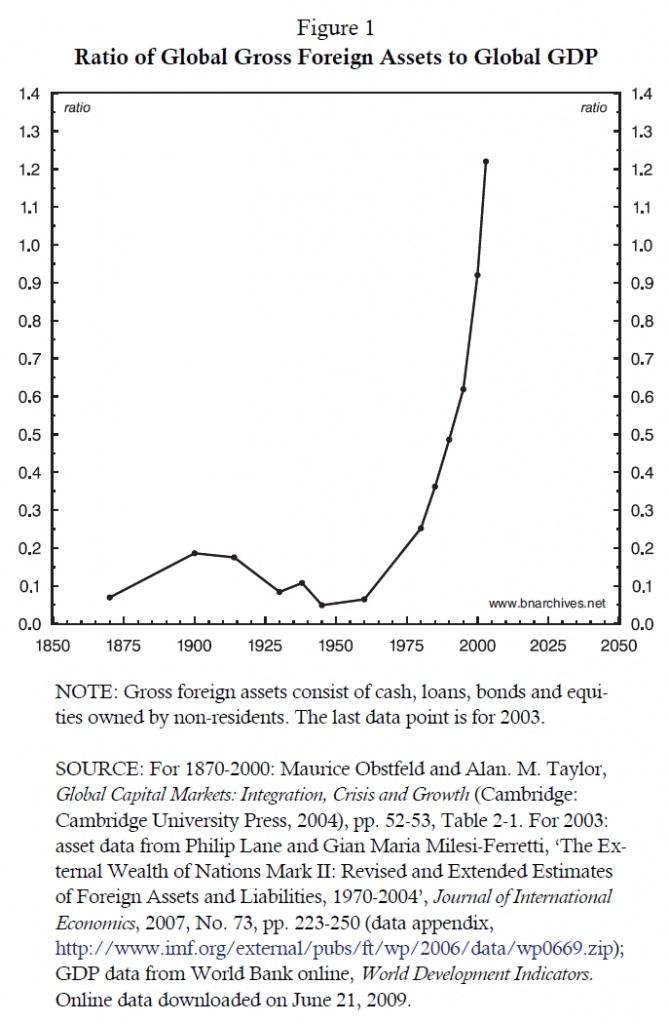

The history of this process, from 1870 to the present, is sketched in Figure 1, where we plot the total value of all foreign assets as a percent of global GDP (both denominated in dollars). The underling numbers, admittedly, are not very accurate. The raw data on foreign ownership are scarce; often they are of questionable quality; rarely if ever are they available on a consistent basis; and almost always they require painstaking research to collate and heroic assumptions to calibrate. There are also huge problems in estimating global GDP, particularly for earlier periods. But even if we take these severe limitations into consideration, the overall picture seems fairly unambiguous. ((The early data on foreign assets are incomplete in that they do not cover all countries (especially smaller ones). As a result, the measured ratio of foreign assets to global GDP in the earlier years of the chart may be somewhat understated (see Maurice Obstfeld and Alan. M. Taylor, Global Capital Markets: Integration, Crisis and Growth [Cambridge: Cambridge University Press, 2004], p. 51-57). ))

The figure shows three clear periods: 1870-1900, 1900-1960 and 1960-2003. The late nineteenth century, marked by the imperial expansion of ‘finance capital’, saw the ratio of global foreign assets to global GDP more than double – from 7% in 1870 to 19% in 1900. This upswing was reversed during the first half of the twentieth century. The mayhem created by two world wars and the Great Depression on the one hand and the emergence of domestic ‘institutionalized waste’ on the other undermined the flow of capital and caused the share of foreign ownership to recede. By 1945, with the onset of decolonization under U.S. ‘hegemony’ and the beginning of the Cold War, the ratio of foreign assets to global GDP hit a record low of 5%. This was the nadir. The next half century brought a massive reversal. In the early 1980s, when Ronald Reagan and Margaret Thatcher announced the beginning of neoliberalism, the ratio of foreign assets to GDP was already higher than in 1900; and, by 2003, after a quarter century of exponential growth, it reached an all time high of 122%.

This final number represents a significant level of transnational ownership. According to recent research by the McKinsey Global Institute, between 1990 and 2006 the global proportion of foreign-owned assets has nearly tripled, from 9% to 26% of all world assets (both foreign and domestically-owned). The increase was broadly based: foreign ownership of corporate bonds rose from 7% to 21% of the world total, foreign ownership of government bonds rose from 11% to 31% and foreign ownership of corporate stocks rose from 9% to 27%. ((See Diana Farrell, Susan Lund, Christian Fölster, Raphael Bick, Moira Pierce, and Charles Atkins, Mapping Global Capital Markets. Fourth Annual Report (San Francisco: McKinsey Global Institute, January 2008), p. 73, Exhibit 3.10. ))

The next step is to break the aggregate front and examine the distribution of ownership. This is what we do in Figure 2, which compares the foreign asset shares of British and U.S. owners from 1825 to the present. The chart shows two important differences between the earlier era of ‘classical imperialism’ dominated by Britain and the more recent ‘neo-imperial’ period led by the United States.

First, there is the pattern of decline. British owners saw their share of global assets fall from the mid-nineteenth century onward, but until the end of the century their primacy remained intact. The real challenge came only in the twentieth century, when capital flow decelerated sharply and foreign asset positions were unwound; and it was only in the interwar period, when foreign investment gave way to capital flight, that the share of British owners fell below 50%.

The U.S. experience was very different. U.S. owners achieved their primacy right after the Second World War, when capital flow had already been reduced to a trickle – and that position was undermined the moment capital flow started to pick up. In 1980, when U.S. ‘financialization’ started in earnest, U.S. owners accounted for only 28% of global foreign assets. And by 2003, when record capital flow and the U.S. invasion of Afghanistan and Iraq prompted many Marxists to pronounce the dawn of an ‘American Empire’, the asset share of U.S. owners was reduced to a mere 18%.

Second, there is the identity of the leading owners. In the previous transition, power shifted from owners in one core country (Britain) to those in another (the United States). By contrast, in the current transition (assuming one indeed is underway) the contenders are often from the periphery. In recent years, owners from China, OPEC, Russia, Brazil, Korea and India, among others, have become major foreign investors with significant international positions – including large stakes in America’s ‘imperial’ debt.

Does this shift of foreign ownership represent the rising hegemony of countries such as China – or is what we are witnessing here yet another mutation of imperialism? Perhaps, as some observers seem to imply, we’ve entered a (neo) neo-imperial order in which the ‘Empire’ actually boosts its power by selling off its assets to the periphery?

The Global Distribution of Profit

Surprising as it may sound, such a sell-off is not inconsistent with the basic theory of hegemonic transition. To reiterate, according to this theory, hegemonic transitions are always marked by a financial explosion which is triggered, led and leveraged by the core in a vain attempt to arrest its imminent decline. Supposedly, this explosion enables the hegemonic power to amplify its financial supremacy in order to (temporarily) retain its core status and power. And if retaining that power requires the devolution of foreign assets and the sell-off of domestic ones, so be it.

The question is how to assess this power. How do we know whether the core’s attempt to leverage global ‘financialization’ is actually working? Is there a meaningful benchmark for power, and how should this benchmark be used and understood?

Unfortunately, most theorists of hegemonic transitions tend to avoid the nitty gritty data, so it’s often unclear how they themselves gauge the shifting trajectories of global power. But given the hyper-capitalist nature of our epoch, it seems pretty safe to begin with the bottom line: net profit.

Net profit is the pivotal magnitude in capitalism. It determines the health of corporations, it tells investors how to capitalize assets, it sets limits on what government officials feel they can and cannot do. It is the ultimate yardstick of capitalist power, the category that subjugates the social individual and makes the whole system tick. It is the one magnitude than no researcher of capitalism can afford to ignore.

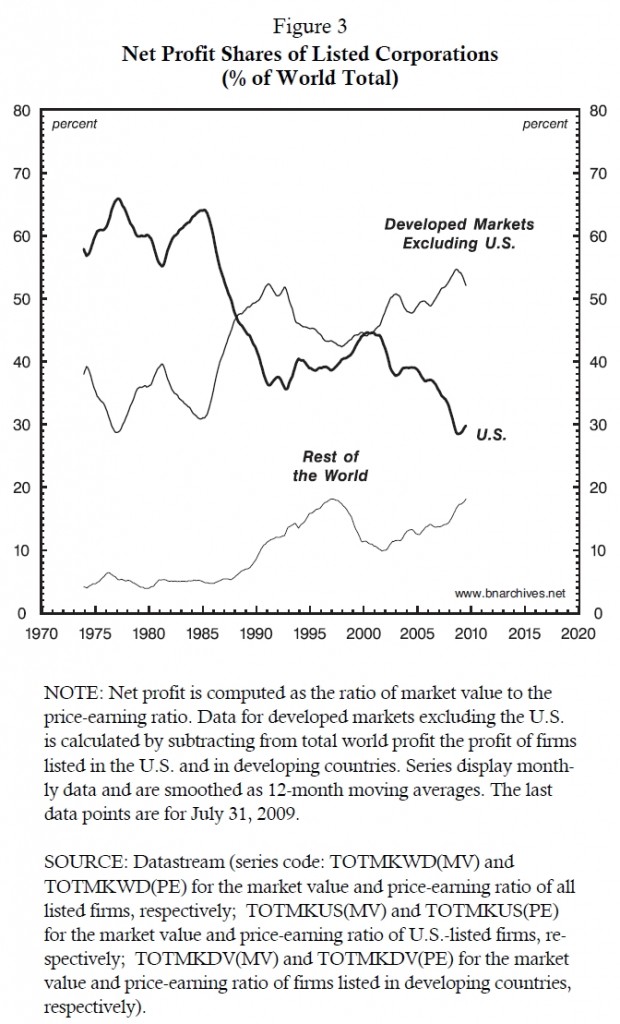

With this obvious rationale in mind, consider Figure 3, which traces the distribution of global net profit earned by publicly-traded corporations. The chart, covering the period from 1974 to the present, shows three profit series, each denoting the profit share of a distinct corporate aggregate: (1) firms listed in the United States; (2) firms listed in developed markets excluding the United States; and (3) firms listed in the rest of the world – i.e., in ‘emerging markets’.

The data demonstrate a sharp reversal of fortune. Until the mid-1980s, U.S.-listed firms dominated: they scooped roughly 60% of all net profits, leaving firms listed in other developed markets 35% of the total and those listed in ‘emerging market’ less than 5%.

But then the tables turned. During the second half of the 1980s, the net profit share of U.S.-listed firms plummeted, falling to 36% in less than a decade. The 1990s seemed to have stabilized the decline, but in the early 2000s the downward drift resumed. By the end of the decade, U.S. firms saw their net profit fall to 29% of the world total.

The other two aggregates moved in the opposite direction. By 2009, the profits of firms listed in developed countries other than the U.S. reached 53% of the total, while the share of ‘emerging market’ firms quadrupled to 18%.

These numbers, of course, should be interpreted with care. First, note that our profit data here cover only publicly traded firms; they don’t include unlisted, private firms. This fact means that variations in profit shares reflect two very different processes: (1) changes in the amount of profit earned by listed firms, and (2) the pace of listing and delisting of firms. The latter factor became important during the late 1980s and 1990s, when Europe and the ‘emerging markets’ saw their stock market listings swell with many private corporations going public – this at a time when the number of listed firms in the United States remained flat.

Second, the location of a firm’s listing says nothing about its operations and owners. Many firms whose shares are traded in the financial centres of the United States and Europe in fact operate elsewhere. And then there is the issue of ultimate ownership. Recall that currently one third of all global assets are owned by foreigners. This proportion is already large enough to make it difficult to determine the ‘nationality of capital’, and if it were to rise further the whole endeavour would become an exercise in futility.

The theoretical implications of these caveats have received little or no attention from students of hegemonic transitions, and their quantitative implications remain unclear. But even if we take the ‘nationality of capital’ at face value and consider the numbers in Figure 3 as accurate, it remains obvious that ‘financialization’ has not worked for the hegemonic power: despite the alleged omnipotence of its Wall Street-Washington Complex, despite its control over key international organizations, despite having imposed neoliberalism on the rest of the world, and despite its seemingly limitless ability to borrow funds and suck in global liquidity – the bottom line is that the net profit share of U.S. listed corporations has kept falling and falling.

The Engine of ‘Financialization’

Now, in and of itself, the collapse of the U.S. profit share – much like the sell-off of U.S. assets – isn’t at odds with the theory of hegemonic transition. To repeat, this theory suggests that the hegemonic/imperial power, having been weakened by its prior financial excesses (among other ills), will kick-start, promote and sustain a system-wide process of ‘financialization’. According to the theory, the latent purpose is to leverage this process in order to slow down the hegemon’s own decline – but nowhere does the theory say that this ‘strategy’, whether conscious or not, has to succeed.

Presented in this way, the story sounds historically compelling, logically consistent and empirically convincing – but only if we can first establish one basic fact. We need to show that the global process of ‘financialization’ indeed has been led by the United States. This is the starting point. Only if U.S. ‘financialization’ preceded, was bigger than and propelled ‘financialization’ in the rest of the world can we speak of the U.S. leveraging this process for its own ends. And only then can we assess whether that leveraging succeeded or failed.

So let’s look at the evidence.

Concepts and Methods

The initial step in this sequence is to measure ‘financialization’. Conceptually, the task may seem simple. All we need to do is calculate the share of financial activity in overall economic activity and then trace the trajectory of the resulting ratio. When this ratio goes up, we can say that the economy is being ‘financialized’; when it comes down we would conclude that it is being ‘de-financialized’.

But that’s easier said than done. ((For a detailed analysis of the associated difficulties and impossibilities that we discuss here only in passing, see Jonathan Nitzan and Shimshon Bichler, Capital as Power: A Study of Order and Creorder (New York and London: Routledge, 2009), Chs. 6-8 and 10; and Shimshon Bichler and Jonathan Nitzan, ‘Contours of Crisis II: Fiction and Reality’, Dollars & Sense, April 28, 2009.))

The basic difficulty is that capitalism is mediated through money, and that fact makes every mediated activity both ‘economic’ and ‘financial’ at the same time. As we have already seen, heterodox economists bypass the problem by defining ‘finance’ more narrowly to denote activities that merely shuffle money and credit without producing ‘real’ goods and services (and obviously without generating any surplus value and ‘actual capital’). Unfortunately, though, this yardstick isn’t very practical. In order to use it, the economist needs to know which activity is ‘productive’ and which is not; and yet, strange as it may sound, this is something that economists do not – and indeed cannot – know. Despite hundreds of years of theorizing and endless claims to the contrary, they remain unable to actually measure ‘productivity’. They cannot quantify the productivity of the CEO of a large bank – or of an auto mechanic for that matter. In fact, they don’t even have the units with which to measure such productivity.

The only thing they can do is to assume. Mainstream economists assume that productivity is ‘revealed’ by income, so if the CEO earns 1,000 times more than the mechanic, he must be 1,000 more productive. Marxists reject this arbitrary assumption; instead, they stipulate, also arbitrarily, that financiers are unproductive while mechanics are productive – although this claim still leaves them unsure of how to treat actual corporations, where ‘unproductive’ and ‘productive’ activities are always inextricably intertwined.

The net result is that we don’t have a clear theoretical definition for ‘finance’ and therefore no objective way to assess the extent of ‘financialization’.

But not all is lost.

We certainly can stick with conventions – and the convention, at least among capitalists and investors, is to treat ‘finance’ as synonymous with the FIRE sector; i.e., with firms whose primary activities involve financial intermediation (banking, trust funds, brokerages, etc.), insurance or real estate.

Based on this conventional (albeit theoretically loose) definition of finance, and given our specific concern here with capitalist power, it seems appropriate to proxy the extent and trajectory of ‘financialization’ by looking at the share of total net profit accounted for by FIRE corporations. The magnitude of this share would indicate the extent to which FIRE firms have been able to leverage ‘financialization’ for their own end, and the way this share changes over time would tell us whether their leverage has increased or decreased.

The Inconvenient Facts

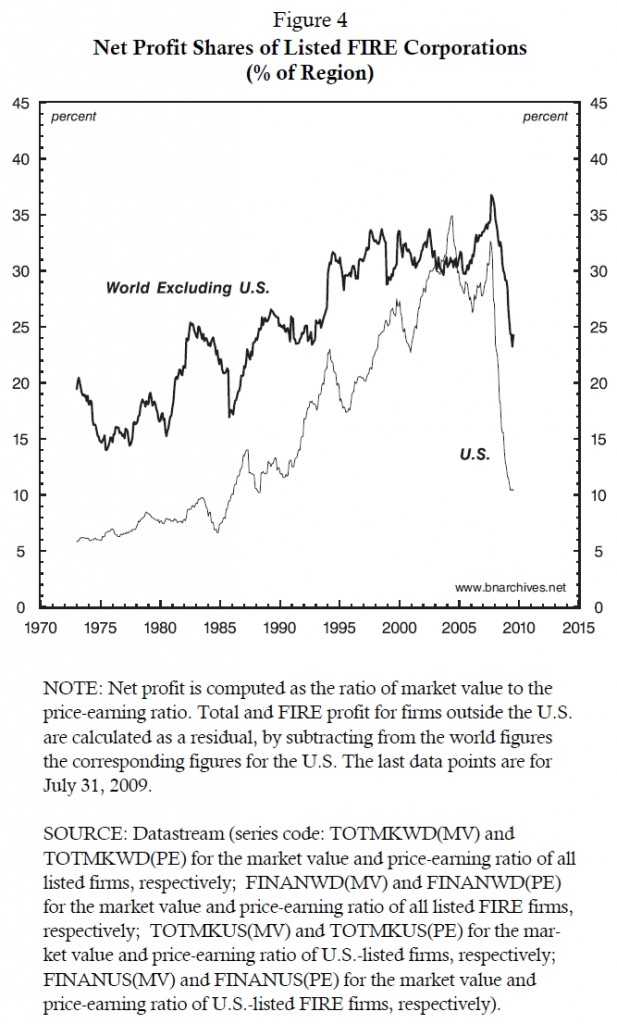

This distributional measure of ‘financialization’ is depicted by the two series in Figure 4. The first series shows the net profit of FIRE corporations as a percent of the net profit of all U.S.-listed firms. The second series computes the same ratio for firms listed outside the United States.

And here we run into a little surprise.

According to the theory of hegemonic transition, the engine of ‘financialization’ is the United States. This is the black hole of the World System. It is the site where finance has been used most extensively to absorb the system’s surplus. It is the seat of the all-powerful Wall Street-Washington Complex. It is where neoliberal ideology first took command and from where it was later imposed with force and temptation on the rest of the world. It is the engine that led, pulled and pushed the entire process.

But the facts in Figure 4 seem to tell a different story. According to the chart, the United Sates has not been leading the process. If anything, it seems to have been ‘dragged’ into the process by the rest of the world. …

During the early 1970s, before the onset of systemic ‘financialization’, the U.S. FIRE sector accounted for 6% of the total net profit of U.S.-listed firms. At the time, the comparable figure for the rest of the world was 18% – three times as high! From then on, the United States was merely playing catch-up. Its pace of ‘financialization’ was faster than in the rest of the world; but with the sole exception of a brief period in the late 1990s, its level of ‘financialization’ was always lower. In other words, if we wish to stick with the theory of a finance-fuelled red giant that is slowly imploding as its peripheral liquidly runs out, we should apply that theory not to the United States, but to the rest of the world!

Indeed, even the most recent period of crisis seems at odds with the theory. According to the conventional creed, both left and right, the current crisis is payback for the sins of excessive ‘financialization’ and improper bubble blowing. ((See Shimshon Bichler and Jonathan Nitzan, ‘Contours of Crisis: Plus ça change, plus c’est pareil?’ Dollars & Sense, December 29, 2008; and ‘Contours of Crisis II: Fiction and Reality’, Dollars & Sense, April 28, 2009.)) In this Galtonean theory, deviations and distortions always revert to mean, ensuring that the biggest sinners end up suffering the most. And since the U.S. FIRE sector was supposedly the main culprit, it was also the hardest hit.

The only problem is that, according to Figure 4, the U.S. wasn’t the main culprit. On the eve of the crisis, the extent of ‘financialization’ was greater in the rest of the world than in the U.S. And yet, although the world’s financiers committed the greater sin, it was their U.S. counterparts who paid the heftier price. The former saw their profit share decline mildly from 37% to 25% of the total, while the latter watched their own share crash from 32% to 10%.

The gods of finance must have their own sense of justice.

The End of a Nexus?

Of course, this isn’t the first time that a monkey wrench has been thrown into the wheels of the ever-changing nexus of imperialism and financialism. As we have seen, over the past century the nexus had to be repeatedly altered and transformed to match the changing reality. Its first incarnation explained the imperialist scramble for colonies to which finance capital could export its ‘excessive’ surplus. The next version talked of a neo-imperial world of monopoly capitalism where the core’s surplus is absorbed domestically, sucked into a ‘black hole’ of military spending and financial intermediation. The third script postulated a World System where surplus is imported from the dependent periphery into the financial core. And the most recent edition explains the hollowing out of the U.S. core, a ‘red giant’ that had already burned much of its own productive fuel and is now trying to ‘financialize’ the rest of the world in order to use the system’s external liquidity.

Yet, here, too, the facts refuse to cooperate: contrary to the theory, they suggest that U.S. ‘Empire’ has followed rather than led the global process of ‘financialization’ and that U.S. capitalists have been less dependent on finance than their peers elsewhere.

Of course, this inconvenient evidence could be dismissed as cursory – or, better still, neutralized by again adjusting the meaning of imperialism and financialism to fit the new reality. But maybe it’s time to stop the carousel and cease the repeated retrofits. Perhaps we need to admit that, after a century of transmutations, the nexus of imperialism and financialism has run its course, and that we need a new framework altogether.