Polarization of the American public reflects the polarization of its political Parties, both of whom strive for ascendancy by demeaning, contradicting, and formulating proposals to wrong the other; each Party wrongs itself and the American public.

The recent and periodic arguments concerning the proposed federal budget, an entrance for initiating threats to “close the government,” highlight how both political sides of Congress wrongly portray the fiscal deficits that have become implicit in federal budgets. Two wrongs do not make a right, and, in this case, they have caused misunderstandings and problems.

Start with the Republican Party

Republicans refuse to admit that an expanded money supply is required to support the increased economic activity of a growing economy and increase the Gross Domestic Product (GDP ). This does not mean that an increase in money supply will increase GDP; the implication is otherwise ─ a given money supply is required to sustain a definite GDP. If production exceeds the money supply for purchasing the goods and cannot be cleared, prices will be cut and deflation will develop. A simple and accepted equation that describes the quantity theory of money certifies this proposition:

GDP = Money Supply x Velocity of Money

With the Velocity of Money constant, GDP cannot increase unless the Money Supply increases, and the Money Supply cannot increase without either banks issuing credit or the Federal Reserve purchasing government notes and bonds, both of which increase total national debt.

More appropriately:

GDP = Consumer spending + Business Investment + Government Spending + (Exports – Imports)

The United States has been running trade deficits for decades, and a portion of government spending equalizes the trade deficit.

TRADE BALANCE

A more significant figure is the Current Account, which is the sum of the trade balance (exports minus imports of goods and services), net factor income (interest and dividends) and net transfer payments (such as foreign aid). If the Current Account is positive, it adds purchasing power to the economy. Since the current account has been in negative for decades, it has been a subtractive figure and an equivalent purchasing power has been transferred out of the economy. The government issues debt to foreign nations and returns the purchasing power to the nation.

CURRENT ACCOUNT

The Republican Party has become the Party vocally rebelling against “big government.” Vocally is the correct word; in practice, Republican administrations have favored deficit spending ─ look at the record.

The federal debt grew slowly until the Ronald Reagan (RR) administration, in 1982, radically increased the slope of the debt curve and used deficits to recover from a recession and continue prosperity. This is the same Ronald Reagan who is credited with the phrase, “the government is not the solution but the problem,” and “believed that reducing the role of the government would lead to increased economic growth, which in turn would lead to higher revenues that would help pay down the national debt.” During RR’s time in office, the national debt almost tripled, going from $1.14T to $ 3.00T. His Republican successor, George H.W. Bush, continued the rising debt trend until Democrat President Bill Clinton ran surpluses. Republican George W. Bush reversed Clinton’s cautious policies and again rapidly increased the federal debt.

After the severe 2008 economic crisis, the Federal Reserve and Treasury Department forced the government into rescue plans that greatly increased the national debt and these plans continued through Democrat Obama, Republican Trump, and Democrat Biden administrations. The reasons for the escalated debt are apparent from an examination of the constituents of public debt.

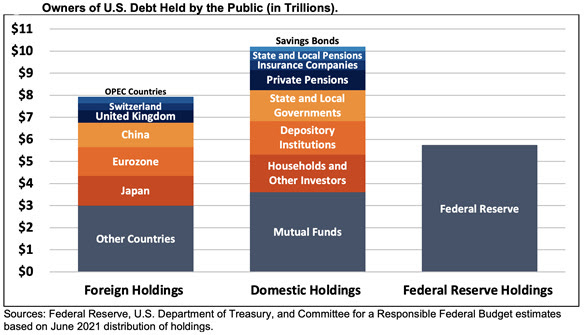

Of the $30T debt, referenced to June 2021, only about $10T was held by American citizens; about $8T was in the hands of foreign creditors, and $6T was held by the Federal Reserve Bank. Intra-government holdings ─ debt between government agencies ─ of $6T, which is not a public problem, completes the total government debt. This breakdown shows that the fiscal policies are not responsible for the elevated debt; the need for elevated debt is responsible for the fiscal policies that drive the elevated budget.

The principal components of the debt are obligations to foreign institutions, including governments, which results from the negative trade balance ─ $850B in 2022 ─ and from Federal Reserve monetary policies of promoting maximum employment, stable prices, and moderate long-term interest rates. From its Open Market Operations, the Federal Reserve accumulated a debt of $6T.

The causes of the negative trade balance are the consumer eagerness for imported goods and the lack of growth of U.S. exports. Due to the pause in consumer purchases during the COVID-19 emergency lockdown, exports had a brief spurt after the lifting of the lockdown and then remained stagnant. This is not a direct government problem; it is a direct problem of a private industry that cannot increase exports, competitively combat imports, and reduce the trade deficit. Private industry shifts the problem to the government, which is forced to retrieve the dollars that leave the country by selling debt.

The Federal Reserve opted to print money and finance debt in order to stimulate the economy during the sub-mortgage loan crisis in 2008 and the Covid crisis, and the federal government became a recipient of that debt. If the Republican Party is serious about reducing the debt, it would examine its sources, which are the negligence of private industry to compete with foreign products and the failure of the Federal Reserve to reduce its balance sheet.

The manner in which former Republican President, Donald Trump, approached the trade deficit demonstrated a lack of knowledge in understanding government debt and how to reduce it. Trump raised tariffs on Chinese imports, which made imports more costly to the American consumer and increased the trade deficit, which led to additional government debt.

The Republican endeavors to reduce the federal budget and slow the increase in debt have merit but it is being done without thought and only for political reasons. Each year some debt is repaid and the money supply accordingly shrinks. With a current account deficit showing no sign of returning to positive territory, to maintain the GDP, new debt must replace retired debt. If private borrowing cannot do more than keep debt constant, the GDP might remain constant. Lacking an increase in private debt, government debt moves GDP to positive growth. Far-right enthusiasts extol the capitalist system and belittle the government debt that anchors the capitalist system in a positive direction.

The chart shows GDP growing as a combination of consumer and government debt. In 1995, to prevent inflation, a sharp rise in consumer debt initiated a pause in government debt. The opposite occurred in 2008, when a drop in consumer debt prompted a massive uptick in government debt.

Continue with the Democratic Party

The U.S. has low unemployment, a more than-marginal economy, and high inflation. The Republicans have a good point: Inflation has too much money chasing too few goods, so why should the government run a deficit to invigorate the economy and provoke more inflation? Analyzing the budget is beyond the scope of this article. Cutting the budget is not beyond the scope of budget makers. A sharp eye with a sharp pencil can do it. If not, what’s wrong with a tax hike, except, of course, it might harm the Party’s election prospects.

Quote Oliver Wendell Holmes: “A good catchword can obscure analysis for fifty years.” Without proof, the Republican Party and Grover Norquist’s Americans for Tax Reform have pushed catchy expressions into our lexicon, casually and with absolute conviction. Two of the most prominent are:

Lowering income tax rates benefits the economy.

Raising income tax rates harms the economy.

These beliefs, which derive from the assumption that if present income tax rates are decreased then total spending in the economy will increase, are shibboleths and not supported by analysis or facts. A simple analysis exposes the fallacies of both expressions.

Taxes transfer money between the government and the taxpayers; neither method adds or subtracts new money nor allows more or less available spending to the economy; in both scenarios, the purchasing power stays the same. The spending may contain different goods and services, but the total purchases of goods and services are identical. Actually, lowering taxes can be detrimental to the economy, while raising taxes may provide definite benefits.

Raising taxes transfers funds from the consumer to the government.

The government assembles huge funds that allow the development and purchase of products, such as airplanes from Lockheed. The manufacturer hires workers to produce the aircraft. The total wages paid to the workers almost match the raised taxes. Spending by the new wage earners ripples through the economy, and, in its final appearance, will almost match the reduced consumer spending of the taxed individuals. Employment, production, and GDP (airplane purchases)have increased ─ give an advantage to tax increases.

Lowering taxes does the opposite; forcing the government to purchase fewer goods and services. The money and spending remain with the already employed and do not incentivize additional employment. Because lowering taxes lowers government revenue, budget considerations might demand an increase in budget deficits.

Lowering taxes mainly assists the already employed, and that is not the major priority. Who pays taxes ─ the employed. Who receives tax breaks ─ those who pay taxes. In effect, lowering taxes redistributes federal assistance from needy persons to the employed. Which is preferable, redistributing income so the employed have more to spend or redistributing the income so the underemployed have something to spend?

Conclusion

Maybe the Biden administration has a good reason for the estimated $1.8T deficit in the 2024 budget, but the present inflation rate of 3.67% encourages a cautious look at increasing demand and pumping an oversupplied economy. Evidently, the Dems fear that the high interest rates will induce a drop in private demand for credit, decrease spending, and trigger a recession. The politicos concluded that the risk of damaging election prospects is higher than the risk of accelerated inflation and getting elected comes before public need.

The last sentence describes the operations of both political Parties ─ their needs come before citizen needs and their policies are designed to benefit themselves. The GOP fails to understand the meaning of government debt and the Dems refuse to use it wisely.

Perceived as a financial evil that corrodes the American government, the green albatross of ongoing federal deficits is an essential element of the free enterprise system ─ a partner to all other debts in an economic order that runs on debt. National debt has a decisive role in maintaining the welfare capitalist system ─ ballast to keep the system floating and reserve energy to prevent it from total collapse. This anti-hero is a prominent savior of free enterprise and those who rail against temporary government deficits without examining its benefits are negligent in their understanding of a capitalist economy and guilty of pushing the economic system into ultimate decline.

Government Debt is not the Problem.

Government legislators are the problem,