In recent years, the ripping off of customers, deceit and even outright fraud practiced by Australian finance sector businesses has gained much attention. Four years ago it was revealed how CommInsure, the insurance arm of the Commonwealth Bank of Australia (CBA), had refused to make promised life insurance payments to heart attack survivors. They “justified” this by using a definition of a heart attack that was so dodgy that even some people who had such a severe heart attack that they had to be resuscitated were denied their entitled pay outs! Such devious practices have been undertaken by finance sector enterprises big and small – from the big four banks and insurance giants to brokers and loan enablers and to retail businesses that hand out loans. As a result the banks, insurance companies and the brokers and others connected to them are widely hated by the masses. With good reason! Yet finance sector institutions have a decisive influence on society. For it is they who determine how credit is distributed and credit is absolutely critical to the running of modern economies. Especially at this desperate time when this country and much of the world face both a public health emergency and economic collapse, it is vital that credit is allocated in ways that can best respond to the COVID-19 virus threat and into areas that can best ensure that the jobs and wages of millions of working class people are guaranteed. Yet would you trust the lying, greed-driven bosses of the banks and insurance companies to do this? You would be totally nuts if you did! We need to put all the banks and insurance companies under state control! In other words, we need to nationalise the finance sector.

In late 2017, there was so much anger built up against the banks, insurance giants and brokers that former prime minister Malcolm Turnbull, realising the need to “restore the credibility” of the finance sector, finally acceded to widespread demands for a royal commission into the banking and insurance industry. That Royal Commission revealed more details of what many of us already knew. Banks were giving secret commissions to brokers to entice them to get home buyers to take out home loans with their particular banks. Banks hid these payments in order to trick their customers into believing that their customers’ “own” brokers were “independent.” But, actually, the payments that these brokers received from particular banks gave them an incentive to get people to take out mortgages with these same particular banks even if that was not the best option for the broker’s customer. And the brokers did this in spades! Moreover, since the commission received by the broker got larger the bigger the loan taken out by their customers, the brokers, with a nod and a wink from the banks paying them, often pushed their customers into buying a more expensive house than they could actually afford. That is part of why household debt is so frighteningly high in Australia.

One of the aspects of the finance sector industry that was exposed is the practice of charging clients fees for no service. Banks and insurance companies and their financial planning and superannuation subsidiaries were found to be charging people “advice” and “service” fees for their investments and superannuation accounts but then providing no advice at all. Put simply, the banks and insurance companies were downright stealing from hundreds of thousands of their customers. AMP, NAB, CBA, ANZ and Westpac were found to be the worst offenders. The amount that these companies stole from their customers through fees for no service was officially estimated to be well over a billion dollars. The real figure could be even higher. Moreover, some of these institutions had even knowingly continued to charge their customers fees for no service … after they had died! The fees would then be paid out of the estate of the deceased customers – in other words, be paid largely by the close relatives of the deceased customers, most often their spouses and children. The Commonwealth Bank even knowingly charged one of their dead clients fees for “financial planning advice” for more than a decade after they died! Meanwhile, insurance giant AMP continued to charge some of their dead customers life insurance premiums.

A Slap on the Wrists for the Swindling Banks and Insurance Companies

The banking royal commission and the media coverage surrounding it tended to focus on atrocities committed against small business owners, farmers and other middle class customers – especially upper-middle class ones – or against better paid workers able to acquire substantial savings. Indeed, under the capitalist system the big capitalists – at the apex of which stand the bank owners – rip off the small-scale capitalist exploiters and all of them, while leaching the most from wage workers, skim off also from the middle class, even from the upper middle class. Yet, the people most hurt by the thieving greed of the banks and insurance companies are average income workers and especially lower-paid, casual and unemployed workers. They are the people most hurt by the banks charging large set fees as these fees often make up such a big proportion of their modest savings. It is poorly paid workers, retrenched workers and long term unemployed workers who are also the most burdened by the extortionate interest rates charged by banks in credit card accounts. It is the low income of these people which pushed them to get into debt in the first place, while the cruel interest rate they must pay off with their debts plus their meagre incomes ensures that many have little possibility of ever paying off these debts. And often desperate for credit, casual and unemployed workers, low income single mothers and people with disabilities are the most vulnerable to being ripped off by loan brokers and short term credit providers handing out loans with exorbitant interest rates.

The banking royal commission did hear about how insurance companies were using aggressive telemarketing and deceptive policies to rip off Aboriginal customers, many struggling on low incomes. It was told of how insurance companies operating in remote Aboriginal communities took advantage of language barriers and Aboriginal people’s tendency to be friendly and polite to sign up on the phone Aboriginal people to life and funeral insurance that they neither truly consented to nor even needed. One of the enterprises exposed for pushing unnecessary funeral insurance on Aboriginal people is the “Aboriginal Community Benefit Fund” (ABCF). With its name including “Aboriginal Community” and its use of a rainbow serpent image, ABCF gave the impression that it was an Aboriginal community-run organisation. But it was not! It was a private, profit-driven company that was neither owned nor managed by Aboriginal people. However, ABCF used the trust gained by the appearance of being a community-run organisation to push Aboriginal people into forking out large amounts for funeral insurance that they did not need. Thus ABCF often signed up healthy young Aboriginal woman in their twenties and early thirties for funeral insurance. They even pushed thousands of Aboriginal parents into getting funeral insurance for their babies in schemes that would cost up to $100,000 over a lifetime! ABCF owners then quietly excluded families of Aboriginal people who died from suicide from receiving payouts, thus ensuring that they would not to have to pay claims of a very large proportion of the insured children that actually did die young.

The banking royal commission did also hear snippets about the massive exploitation of low-income people by businesses handing out consumer leases and so-called payday loans – where people are lent money until their next pay check at massive interest rates. Aboriginal financial counsellor, Lynda Edwards, also told of how car dealers took advantage of the necessity for cars in remote areas to sell Aboriginal people dud cars with ultra-high interest loans. A report published a year ago by Flinders University detailed how one Aboriginal customer was made to pay $52,000 for an $18,000 car at an interest rate of 35% despite the fact that the over-priced used car stopped working long before the loan was repaid! Indeed, the royal commission was told of how some Aboriginal people had been charged even higher interest rates for car loans, rates of 48%!

Yet the nature of the Royal Commission was such that it did not compel those involved in such scams and high-interest loan pushing to defend their actions. As senior counsel assisting the commission, Rowena Orr QC, explained: “We will not be considering consumer leases, payday loans or in-store credit arrangements in these hearings because they do not fall within the terms of reference of the commission.” Put simply, the Royal Commission was not meant to truly protect the interests of low-income people from the predatory behaviour of banks, insurance firms and retail business owners. To the extent that the banking royal commission was not entirely about “restoring the credibility of the finance sector” or simply about allowing the furious masses to vent steam in a way that does not actually harm the interests of the finance industry bigwigs, the investigation was aimed at curbing the excesses of the bank owners in the interests of other sections of the capitalist class – including retail sector bigwigs, “small and medium size” enterprise bosses and big farm owners – as well as the more privileged sections of the middle class that the upper class rely on for social and political support. After all, the state in capitalist countries is an executive committee for managing the affairs of the capitalist labour-exploiting class as a whole. At times they have to slightly clip the wings of even their most powerful section – the finance sector bigwigs – in order to ensure the interests of the rich ruling class as a whole. But even here the Royal Commission’s impact was minimal. Sure, there were some stunning revelations of the depth of the banks and insurers’ greed and deceit. Several finance sector CEOs and directors also had to resign from their positions in the wake of the revelations and, mind you, then take away multi-million dollar severance pay and shareholdings, thank you very much. Yet Royal Commission head, Kenneth Hayne, did not recommend one single charge against any specific finance sector boss despite the fact that the hearings of the commission plainly showed that banks and insurance companies had stolen and swindled well over a billion dollars from hundreds of thousands of their customers. Instead, the commissioner handed over 24 recommendations to the regulators over instances of misconduct and charged them with the responsibility of considering any action. However, he refused to even name the people and institutions involved. And over a year since the final report of the commission was handed down, not a single finance sector boss has been charged let alone been put behind bars. Meanwhile, even after having promised to implement nearly all of Commissioner Hayne’s recommendations, the government has yet to even introduce legislation to turn several of the recommendations into law.

The more important point is that Commissioner Hayne’s report only recommended cosmetic changes to the finance sector. Cold calling of financial products over the phone was recommended to be banned and mortgage brokers would be required to act in the best interests of their customers (as if that is going to actually happen!). However, the economic power, profitability and overall impunity of the finance sector corporations will be largely untouched. In fact, the bank owners were so delighted with the outcome of the Royal Commission that the first stock market trading after the commissioner handed down his final report saw the share prices of the big four banks skyrocket by almost A$20 billion – their biggest one day rise ever!

The limp recommendations of the Royal Commission are, indeed, what the right-wing Australian government always intended to be the outcome. Indeed, the Liberal government was so intent on enhancing the reputation of the bank bosses that shortly before the Royal Commission was announced, they and the bank heads arranged for the bank bosses to send a letter to the government themselves calling for the Royal Commission! This enabled the government to put the bank bigwigs in good light by saying that the banks themselves wanted the inquiry. Indeed, the relationship between bank owners and the government is so cosy that the letter from the heads of the big four banks to the government calling for the Royal Commission was first sent in draft form to the then treasurer, Scott Morrison, to be vetted by him before being made an official letter the next day! Let’s not forget that the then prime minister, Malcolm Turnbull, who, kicking and screaming, called the Royal Commission was himself the owner of an investment banking firm and later a managing director for the Australian arm of U.S. banking giant, Goldman Sachs.

In order to appease their working class base and appeal to widespread middle class public opinion, the ALP Opposition has been more critical of the banks than the Coalition government. But let us remember that when they were in government previously from 2007 to 2013, when some of the most blatant fraud by the finance sector companies was being committed, the ALP also did nothing to stop it. Today in the wake of the Royal Commission, the ALP only called for implementing its weak recommendations. Nothing more. The ALP are certainly not calling for putting the banks under state control or even under greater regulation. After all it was the former Hawke-Keating ALP government that carried out the biggest deregulation of the finance sector in Australian history. They removed the cap on the interest rates that banks could charge for home loans and abolished other controls on bank interest rates. In short, the Hawke-Keating Labor government freed up bank owners to do whatever it takes to maximise profits regardless of the consequences to society. Most harmfully, they also privatised the formerly state-owned Commonwealth Bank.

While the ALP is a party with a working class base, its futile program of trying to improve the lot of workers while accepting the capitalist order means that it necessarily needs to collaborate with – and ultimately kowtow to – that apex of capitalist power, finance capital. Thus, the ALP’s ties to the bank bosses are not far behind those of the conservatives. The investment banking firm that Malcolm Turnbull established, referred to above, was actually set up in a partnership with none other than former NSW ALP premier, Neville Wran, and Nicholas Whitlam – the son of former prime minister and ALP icon, Gough Whitlam. The bank was actually called Whitlam Turnbull & Co Ltd. Today, the CEO of the Australian Banking Association, who has done so much to deceive the population by being the chief apologist for the bank bosses is former Queensland ALP premier, Anna Bligh. Meanwhile, during the last financial year that disclosures of political donations have been revealed, 2018-19, the ALP received more than $2.5 million from Westpac alone! They were also given $50,000 from the main body representing general insurance firms, the Insurance Council of Australia, as well as plenty of other big donations from individual insurance companies and other banks. And that does not include the large amount of political donations that are disguised or hidden.

Of course, the banks and insurance companies also made big donations to the Liberal Party too. The Insurance Council of Australia gave them $27,500 and Anna Bligh’s Australian Banking Association the same amount. For its part, CBA donated $55,000. Westpac Bank donated a hefty $82,500 to the Liberals but that pales against their $2.5 million donations to the ALP during 2018-19. Likely, the Westpac bigwigs knew that they already had the Liberals fully in their bag!

The Myth that the Big Corporations are Owned by “Everyday Australians” through Our Superannuation

The problem isn’t simply that the banks and other finance businesses sometimes engage in open theft from their customers and other deceptive conduct. It’s the normal working of these enterprises that is the main problem. Banks make their money by extracting fees from account holders and primarily by charging a higher interest rate on the loans that they give out than the rate that they pay depositors. And they leach a lot of money that way! In the 2018-19 financial year, the “big four” Australian banks and the three biggest Australian-owned insurance companies, IAG, Suncorp and QBE, together extracted nearly $29 billion from us and that’s not including the huge amounts also grabbed by smaller banks and insurers as well as by mortgage brokers, consumer lease providers and payday cash operators. And that was considered a bad year for them! All this money extracted by the finance sector businesses is like an extra tax on the masses. But it is a tax where the proceeds don’t go into the public budget but into the hands of the wealthy finance sector business owners. If we note that there are currently about 9.8 million households and then do a quick calculation we find that the biggest four Australian-owned banks and largest three Australian-owned insurers are leaching $3,000 in profit, on average, from each household every year. To put that in perspective, that is more than one in five dollars of what an unemployed single person receives in the Newstart Allowance (if one excludes the temporary increase to the Newstart Allowance granted during the Covid-19 pandemic)!

Most working class and middle class people are only too aware that “The Banks” are ripping us off. But who do we exactly mean when we talk about “The Banks” that leach from us. Most of us think of the CEOs and the directors that award themselves huge salary packages. And with good reason! Last year, Westpac’s CEO took home over $5 million, ANZ CEO Shayne Elliot even more and IAG CEO Peter Harmer topped the lot receiving a five and a half million dollars package. And that was all in a year when the bank bosses, aware that they were under the spotlight, wanted to pretend that that they were feeling contrition for their devious deeds by awarding themselves lower payments than usual!

Yet as obscene are the payments are to the bank executives, that is still only a small percentage of bank profits. Where else are banks gigantic earnings going? Certainly not to their rank and file employees! So let’s take a look at Australia’s biggest bank, CBA. Last financial year CBA had a total operating income of $24 billion. Some of it they spent on equipment, wages, occupancy and operating costs. Most of their income then, after paying tax, ends up as profit for their owners. Nearly $8.5 billion to be precise. Of that nearly a billion went to beef up the assets of the bank to help its owners make greater profits in the future and $7.6 billion was given as dividends to the banks shareholders, i.e. to the banks owners. That’s who is taking most of the wealth extracted from the masses by the banks. By contrast, the more than 48,000 employees of the CBA received $5.5 billion in salaries and superannuation, which is a lot less than the shareholders received for doing absolutely no work at all. The amount received by the bank employees is also less than a quarter of the bank’s overall operating income. And of these more than 48,000 employees, the majority of them, the rank and file employees – say at least 40,000 of the workers – would each receive small slices of the salary cake while the managers and executives each take gluttonously big slices. After all, the bank’s top executives and other directors (there are just 20 of them), alone were paid $40 million last year; and that is counted as a “staff” cost. By contrast the average salary package, including superannuation, of CBA’s other employees is $114,000 – which is 40 times less than what the CEO took home. Moreover, when you exclude the managers and others in the top 20% of highest paid staff who would bring up that average income number, one would find that the annual wage of the vast majority of CBA workers wouldn’t be much more than – and in many cases less than – $75,000 and certainly well below $100,000. Moreover, to the bank bigwigs, these bank workers are expendable. As soon as the bank bosses decide that they can make a still higher profit with fewer workers, they will throw into the dole queues the employees whose hard work has allowed bank executives and big shareholders to acquire such immense wealth. Over the last several years, the bigwigs of the big four banks have together retrenched tens of thousands of workers. In late 2017, then NAB CEO, Andrew Thorburn, infamously announced the axing of 6,600 jobs at the very same time that he gloatingly announced that the bank had made a whopping annual profit of $6.6 billion.

So, who then are the shareholders who are reaping the rewards of the banks’ ripping off of the masses’ money? The finance corporations’ bosses and their bigwigs try to sell us the line that their companies are owned mostly by superannuation funds and through the dividends distributed to these funds their profits end up going to “ordinary, everyday Australians.” Nothing could be further from the truth! But before exploring this point in more detail, it is important to here make a point about superannuation more broadly. Superannuation, as a means of distributing income to the aged, in contrast to pensions, is not fair. It is not fair not only in practice but in the very concept of it.

Under the superannuation system a proportion of people’s income (9.5% of their gross wage currently) when they are working goes into their personal accounts which gets managed by superannuation companies and is then accessible when they retire. So a worker on the minimum wage in a full-time job gets $3,467 of superannuation put into their account each year. By contrast, the Westpac CEO last year received $44,320 in superannuation payments, nearly 13 times more than a worker on the minimum wage gets. Many bosses get even more. Last year, the CEO of Australian-owned mining giant, BHP, received a staggering $425,000 in superannuation payments – that’s more than 120 times greater than what a worker on the minimum wage gets! By contrast if you are a worker unfortunate enough to be either unemployed or one of the increasing number of cash in hand workers or a domestic worker or a casual worker who gets only a few hours in a month of work you get no super whatsoever. Yet it is precisely these people who need higher payments when they are aged because they would have much less savings and assets than people who had been receiving higher superannuation contributions. Moreover, the superannuation system reinforces the discrimination in employment affecting women, Aboriginal people and migrants from African, Middle Eastern and Asian countries. For in addition to the gender pay gap that women endure, the racist discrimination that causes Aboriginal people to have a much higher rate of unemployment than the broader population and the greater propensity of migrants to only be given lower paid jobs, women and migrants are much more likely to be in non-super receiving cash in hand and domestic work jobs than their male and Australian-born counterparts.

There is one rationale for superannuation – that wealth produced today needs to be set aside for when we have an ageing population in the future – that does have validity. But this should be addressed by making the bosses pay into a single, common pension fund out of which aged pensions can be paid equally to all of the elderly. Instead of the system of low pensions supplemented by people’s individual superannuation accounts, there should be much higher pensions for all and no individual superannuation. At least when a group of people are at an age when none of them are working, they should finally get paid equally! The current system, instead, carries through all the terrible inequality when people are of working age through to when people are retired.

So given how unequal people’s superannuation balances are, even if it were true that the banks and other big corporations are owned mainly by superannuation funds this would be grossly unfair. However, the truth is even more inequitable. For it is the very rich who own most of the stocks of the banks and other big companies. Superannuation funds own just a minority. How small a minority? Let us calculate that here using publicly available data. Given how much mythology there is about superannuation funds owning corporations, we will show each stage of the calculation. According to the Association of Superannuation Funds of Australia, i.e. the industry body of the superannuation companies themselves, at the end of December 2019 these funds had a total of 1.9 trillion dollars in assets of which 22.0% was invested in Australian equities (https://www.superannuation.asn.au/resources/superannuation-statistics , accessed 3 April 2020). That comes to a figure of $418 billion for the total holdings in the Australian share market by the superannuation funds. Now the total market capitalisation of the Australian share market at the same time, the end of December, was $2339.71 billion (see https://www.gurufocus.com/global-market-valuation.php?country=AUS and scroll to 20 December 2019 in the graph “Australian Total Market Cap”). That gives the proportion of the shares in the Australian stock market owned by domestic superannuation funds at just 17.9%. That is a lot less than one in five shares.

To see the significance of this truth that local superannuation funds own just a minority of major Australian corporations, let us consider the following scenario. Imagine in the year 2022, after having to prune their profits slightly in 2019 following the exposure of some of their fraudulent practices and the lower profits that they could expect in the coming two years in the wake of the COVID-19 induced recession, the banks seek to raise their profits back to the extreme levels of a few years ago. Through hitting their customers with still higher fees and by charging a high interest rate on the loans they lend out relative to that which they give to depositors the banks raise their profits by, say, an extra $10 billion. Now the bank bosses and their many apologists in parliament would then spin the line that these higher profits are a good thing as they end up in the pockets of “ordinary everyday Australians” through the dividends being accumulated by superannuation funds investing in the banks. However, if all these additional profits end up being distributed as dividends to shareholders and assuming that the percentage of bank shares owned by Australian super funds is about the same as the overall proportion of Australian stocks owned by these funds, just $1.79 billion of these extra share dividends would go to these funds. Even less would make their way into actual superannuation accounts. For the superannuation companies would take a healthy portion of the dividends as commissions and fees – and as we know even as advice fees when they give no advice! And guess what, many of these superannuation companies are themselves directly owned by banks or insurance companies. So part of the bank profits supposedly going into superannuation funds end up going back to the bank and, thus, into the pockets of its big non-superannuation shareholders. The amount actually going to the superannuation accounts of the public may be closer to $1.4 billion. Yet, to get to this scenario of higher bank profits, we have paid out $10 billion in extra fees and higher interest payments. So, excluding the big shareholders of the banks, the public end up much worse off overall, worse off by about $10 billion less the approximately $1.4 billion that we reclaim in higher returns on our super; i.e. we together end up about overall $8.6 billion worse off. And it is working class people who would suffer the pain disproportionately. For a low-paid worker, while paying the higher fees and higher interest rates paid by others, gets very little back in the way of higher returns on their superannuation and many workers none at all.

While we are dealing with this subject, the same analogy would apply to the issue of wages and profits. If the bosses managed to drive down our wages throughout the economy so that they collectively make a $10 billion higher profit than they otherwise would, the apology that business leaders give, that this ends up back in workers’ pockets through increases to their superannuation, is completely false. Wage and salary earners would collectively end up about $8.6 billion worse off. And again the pain would be borne most by lower paid, cash-in-hand and unemployed workers. So, the next time a co-worker, who has been influenced by ruling class propaganda, tries to tell you that higher profits for banks and other corporations is good for us, please, please, please educate them about the reality!

Who are “the Banks”?

So now that it is clear that we are not the indirect owners of the banks through our superannuation funds, who then are the actual owners of these hated corporations? The second lie that apologists for the banks promote, other than the one about superannuation funds, is that the banks are simply owned by “ordinary, everyday Australians” – so called “mum and dad shareholders.” This is actually an even bigger lie than the first one! Why? Firstly, most working class people don’t have the significant savings that would enable them to invest in the stock market. Low paid workers, unemployed workers and casual workers struggle to replace worn out clothes, deal with high electricity costs, pay the rent and often keep up with credit card debts too, let alone save significants amounts of money. Meanwhile, more decently paid workers often spend most of their working life paying off their home mortgage. Far from the majority of the working class being able to invest in shares, the reality is that household debt in Australia is at record levels. A small layer of better paid, more skilled and often older workers do sometimes invest in shares or alternatively in wealth management schemes that in turn invest in shares. However, most of the people holding shares are members of the capitalist, business-owning upper class and the more comfortable layers of the middle class – especially high-paid, upper-middle class professionals. So the “mum and dad shareholders” who supposedly hold most of the banks should more precisely be referred to as the “affluent mum and dad shareholders.” However, even this tells only a small part of the story. For average middle class shareholders – and even the upper middle class ones – while they are large in number only hold a very small portion of bank ownership. To see this, let us have a look at the latest annual report, the one for 2019, for Australia’s largest bank, CBA. According to the bank’s own report, those owning less than a 1,000 shares, who make up nearly three quarters of shareholders, own just one in ten of all shares. Now, given that the share price of the bank at the time that those figures were quoted for (15 July 2019) was $81.06, any one shareholder who was not in this category, i.e. was a shareholder who had more than 1,000 shares in the bank, had more than $81,060 invested there. These big investors who each invested more than $81,060 in the bank own 90% of the bank. Few workers and average middle class people could afford to put that kind of money in the shares of one company. Moreover, even amongst the upper middle class and wealthy capitalists who own most of the bank shares, it is the latter who own the lion’s share. Thus, the people and institutions who own more than 5,000 shares – that is who have the spare cash to invest more than $405,000 in the shares of just one company – own over two-thirds of the CBA. Moreover, the top 20 shareholders alone own nearly half the bank!

So who then are these very rich individuals owning most of Australia’s banks? That is censored information! The wealthy own much of their stakes in the finance sector through other banks acting as nominees for them. In other words, these rich investors get other banks to hold shares on their behalf in a way that hides their own identities. Without exception, in Australia’s big four banks at least the top six shareholders in each bank are these bank nominee holders. In the case of ANZ, all the top eight shareholders, who own 57% of the bank, are these nominee holders. That about typifies the nature of “democracy” within capitalist countries. The ruling class talk a lot about “transparency” but really it is only things that don’t matter too much that are transparent whereas the really important stuff is hidden from the masses. So here we have the most powerful economic institutions in the country, the ones who decide how credit is distributed and whose combined assets of $3.4 trillion (for the big four banks alone) are almost twice the country’s entire annual GDP … and we don’t even really know who owns them!

We do, however, know a few things about the major owners of the Australian banks and insurance companies. One thing that we do know is that they are rich Australians rather than people from overseas. CBA, for instance, is nearly four-fifths Australian-owned. You can bet that among the major owners of the banks and insurance companies, hidden through bank nominee holders, are many of Australia’s richest 200 people – capitalists whose combined wealth last year was found to be a staggering $342 billion! So if you managed to break through the secrecy wall of nominee holdings you would surely find that among the major shareholders of the banks would be people of the ilk of Andrew Forrest, Gina Rinehart, James Packer, Anthony Pratt, Clive Palmer and Kerry Stokes.

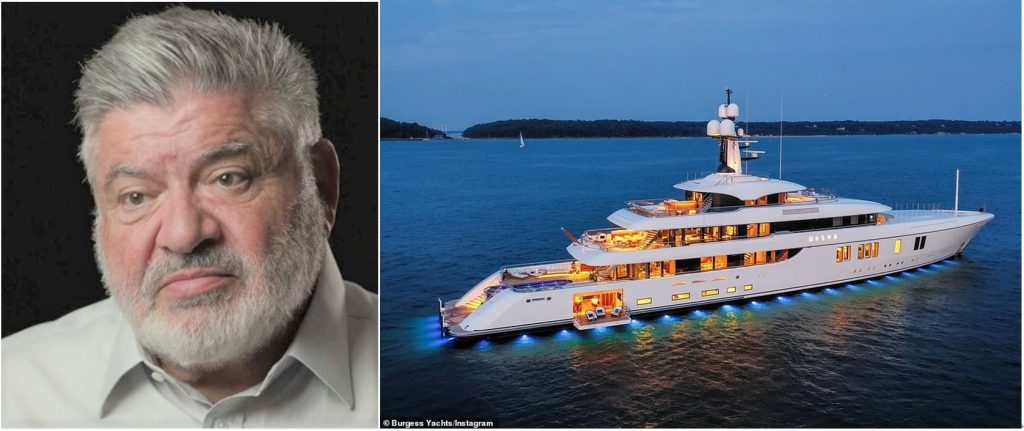

Where there is greater transparency is in the holdings of the executives and directors of these finance sector corporations. And they do have big shareholdings. ANZ CEO, Shayne Elliot, held nearly $5 million of shares in that bank. IAG boss, Peter Harmer, owned an even larger stake in his corporation, owning $7.6 million of shares. However, compared to the murky holdings held in secret by nominee companies, even these huge numbers are pretty small. One big bank shareholder who is not hidden behind a nominee company is the couple, Barry and Joy Lambert, who at the time of the CBA’s last annual report owned a whopping $220 million dollar stake. Joy and Barry Lambert are indeed, by the way, a “mum” and a “dad” – and these are precisely the type of “Australian mums and dads shareholders” that own the lion’s share of this country’s banks and other major corporations!

The Big Banks, Big Insurers and the Owners of Smaller Finance Companies

What about the institutions holding major stakes in the big finance corporations – that is, other than the companies acting as nominees for others? One such institutional investor, which is among the top twenty shareholders of each of Australia’s big four banks as well as of the big insurers, Suncorp and QBE, is Netwealth Investments. If we look at the last annual reports of these big finance corporations, we find that at that time, Netwealth held a total stake of $814 million in them. Now Netwealth Investments are a wealth management firm, so they are largely investing the money of other capitalists and upper middle class individuals in the big finance corporations. But Netwealth also takes a big chunk out of the money invested through these shareholdings as commissions and management fees. And who owns Netwealth? More than half of it is owned by the joint managing directors of the firm, Michael Heine and his son Matt. The last published Australian rich list has the family holding a combined wealth of more than $1.5 billion. As we can see, a big part of this wealth comes from grabbing a share of the profits that the banking and insurance corporations leach out of all of us.

So there you have it, the big banks and insurance companies act as a big collective feeding trough for capitalist pigs. Different capitalist exploiters come to put their snouts into the mega-earnings extracted by the big banks and insurers. And when they do so, they get a huge feed. The last CBA annual report, for example, boasted that shareholders gained a total return on their investments of 21% in just one year. That means, for instance, that the Lambert family’s stake in the bank would have given them a $46 million return in just one year … and that from doing no work whatsoever! By contrast a full-time cleaner doing hard and especially crucial and dangerous work at this time of pandemic will get 1,200 times less than this and only if her boss actually pays her the minimum wage.

The Heine family who own Netwealth are one of many owners of smaller finance sector businesses that have made a fortune by engaging in a similar kind of parasitism as the big banks do. At least fifteen of the people on Australia’s list of the richest 200 people extracted much of their money by running such enterprises. You very often see these people being interviewed on ABC current affairs programs related to the economy, which is worth noting for anyone who thinks that the ABC is substantially fairer and more independent of capitalist influence than the tycoon-owned media outlets. Among the finance sector bigwigs are Hamish Douglass, the biggest shareholder of wealth management firm, Magellan Financial; Jeff Chapman, owner of Bennelong Funds Management; Graham Tuckwell, owner of investment management firm, ETF Securities; David Paradice, owner of Paradice Investment Management and Kerr Neilson, the billionaire who owns the main stake in Platinum Asset Management. Supporters of public housing may recognise the latter name. Neilson was one of the ultra-rich people who notoriously bought up former public housing and publicly-owned buildings in Sydney’s inner-city Millers Point after the right-wing NSW government drove out low-income working class tenants and sold off the housing to wealthy individuals and speculators. In 2018, Neilson bought up three historic dwellings in Millers Point, known collectively as the George Talbots Townhouses, for $5 million.

Another filthy rich owner of a finance sector corporation is the boss of buy-now-pay-later company, Flexigroup, Andrew Abercrombie. Abercrombie is also a Liberal Party powerbroker and major donor and is notorious for having stridently supported right-wing extremist, media commentator Andrew Bolt, when Aboriginal people took legal action against Bolt over vile racist slurs. Recently, Abercrombie was in the news after a high-society party that he hosted at his extravagant chalet in the US Aspen ski resort became the source of COVID-19 infection clusters after several of the super-rich guests refused to self-isolate and after returning to Australia spread the disease acquired at the party to Melbourne, Victoria’s Mornington Peninsula and Sydney.

Many of the finance sector bosses in Australia’s rich list run businesses that not only make profits from operations here but also leach profits from people overseas. That is to be expected from major components of a ruling class that is not only capitalist but imperialist. However, as well as making profits from their own operations, these owners of smaller finance sector companies stand alongside mining magnates, media moguls and industrial capitalists in grabbing hefty slices of the loot extracted by the operations of the big banks and big insurers. This is both through their own major shareholdings in the banks – like those of the Lambert family who made their initial wealth through Barry Lambert’s previously owned financial planning company, Count Financial – and through gaining a big slice of the dividends from bank shares received by the funds that they manage. In this sense, the big banking and insurance companies operate like a legal, crime syndicate. Different, loosely connected capitalists come together through these corporations to jointly loot the masses.

Nationalize the Banks! Nationalize the Entire Health System!

The banks extract money from the masses in four different ways. The first two ways are obvious: through charging interest and fees and through exploiting the mental labour of their own workers. Thirdly, by lending to those buying investment properties, banks, from the interest that they receive, gain a share of the rent extracted by greedy landlords from tenants. There is also an important additional way that banks extract their revenue. For banks, insurance companies and investment managers put some of the money under their control into the shares and bonds of other businesses. In the case of banks they also make loans to these other firms. These other business bosses, whether they be those of manufacturing firms, retailers, developers, telecommunication and IT firms, transportation companies, mining corporations or agribusiness operations in turn make a profit through exploiting their own workers. Part of the wealth extracted from these workers is then returned to the banks as interest on loans and on any bonds held by the banks and also returned to finance sector firms more broadly as dividends on the stocks that they hold in these other companies. In this way, the owners of the finance sector companies gain a share of the profits exploited from workers throughout the economy.

This role of the finance sector – and the banks in particular – in the whole economy points to perhaps the biggest problem with the capitalist-owned finance sector. It is not simply that they leach from the people, it is also the way that they allocate credit and financial resources. And like everything else they do, they allocate credit almost solely on the basis of what can bring them the highest returns. That is partly why there is so much speculation in the housing sector and so little affordable housing available, both to buy or to rent. Banks know that they can gain much higher and more secure returns by giving loans to wealthy people buying multiple holiday homes and speculative high-end investment properties than to lend for the construction of cheaper housing for working class people to buy or to rent. Similarly, banks would rather allocate loans and investments to climate change-inducing coal mines and fossil fuel power stations that have little long term future than to focus their credit allocation into renewable power projects even if the former bring only slighter higher and more secure returns to the bank. Meanwhile, the profit-driven mode of the banks mean that medical research in Australia can struggle to get funding unless the chances of an immediate profit-making breakthrough are immediate. Yet medical science cannot but advance except through the trialling of many different ideas, only a tiny proportion of which will end up being used. Similarly in Australia, important technological development and scientific research – especially in basic sciences where the monetary benefits are not immediate – struggle to get bank loans or investment. By contrast, casino operators and advertising firms – who produce no net benefit to society but instead only help one lot of business owners to get richer at the expense of their rivals (and then vice versa!) – don’t seem to have any trouble raising credit.

Photo credit: ABC

If the misdirection of credit causes terrible problems in “normal” times, it can be literally fatal at a time of public health emergency and economic implosion like we are experiencing right now. Although, as we go to press, the rate of new infections in Australia appears to be slowing, people continue to die from COVID-19 and, what is more, the threat of much greater virus spread will emerge once social distancing measures are eased. That is why immediately, we need financial resources directed to urgent medical research to help find vaccines and better treatments for COVID-19. We need this research not only for the few projects seemingly most likely to bring financial profits in the future but for a wide range of research. That includes work into developing any non-vaccine treatment methods for the virus. Such research into treatment methods can be hugely life-saving but its results are also likely non-patentable and would bring the researchers – and thus their bank creditors – no real financial rewards. Even more urgently we need loans directed to particular manufacturers that are able to very quickly turn their factories into making personal protective equipment, infra-red thermometers, virus testing kits and ventilators. We also need credit being allocated into areas that will help reduce the level of job losses and at the same time direct jobs into areas that would aid the virus response – for instance by making home delivery of groceries and food more widespread. Yet the only way any of this has even a chance of happening is if control of the organisations that have the power over lending – that is, the banks – are taken out of the hands of their profit-driven owners and brought under state control. This gives the potential to plan the allocation of financial resources to both respond to the virus threat and avert economic collapse. For such planning to be effective, the banks really need to be run together as a single national entity. Modern computing technology and big data make that quite simple whether or not the banks actually operate under one logo. In summary what we need is the nationalisation of the banks and their conversion into a single state-run bank. We need that right now and we need that all the time!

Putting the banks under state control is not the only thing that the working class masses need right now. To respond to the COVID-19 threat we need health resources mobilised in a planned way. The government has announced that it would requisition the resources of private hospitals to deal with the crisis. But this measure is partial and predicated on a massive bailout of private hospital owners. In contrast to the Morrison government’s half-baked hospital plan we need the immediate nationalisation of the entire health system – including not only private hospitals but smaller health facilities like pathology labs. This must remain even after this epidemic is over. Having a big part of the Medicare budget going into the bank accounts of greedy private health operators – for example, Medicare pays 75% of the schedule fee of private patients – as opposed to the actual treatment of patients not only drains the public budget but means that less resources are available for the long overdue tasks of increasing the number of available public hospital beds and public health nurses and reducing the waiting times at public hospitals. Furthermore, for the level of one’s access to health care to depend on the “logic of the market” – in other words how much money one has to fork out for health care – goes against the needs of the working class and all principles of decency. The irrationality of having health facilities being run by for profit operators has been proved during this COVID-19 crisis by the fact that private health care operators like Healthe Care in March stood down, or laid off, hundreds of nurses at a time when the virus was spreading rampantly and nurses were needed more than ever.

The section of Australia’s population most vulnerable to contracting COVID-19 is the well over hundred thousand homeless people. This includes not only those forced to sleep the streets but those “couch surfing” in the homes of friends and relatives. With so many people thrown out of work or stood down on reduced or no pay, homelessness is set to skyrocket. The government’s tentative six-month moratorium on evictions does not provide adequate security to tenants. There are so many loopholes that landlords are already evicting tenants. Moreover, current measures do not stop landlords and estate agents from pressuring tenants to pay rent even when they have little income. Therefore, there must be a six month halt to all rent payments for residential tenants from now. We also need an immediate halt to the sell-off of public housing and for homeless people to be housed in public housing dwellings slated for sale. This will help but will not in itself be enough to house all homeless people. Therefore, we also need a massive increase in public housing. Another crucial reason why we need more public housing is so that low-income women can move away from any abusive relationships and know that they will still have a roof over their heads if they do so. This is an even more urgent matter now than ever as COVID-19 restrictions are leaving women copping domestic abuse in situations where they are more socially isolated and, thus, more vulnerable to violent attack. But new public housing cannot be built fast enough right now in the midst of a pandemic. Therefore, the state must requisition the unoccupied holiday homes and investment properties of people owning more than three homes and convert them immediately into public housing.

We must also demand that the millions of casual workers in this country be immediately granted permanency with all the rights of permanent workers – including being granted guaranteed minimum work hours and sick leave. This is necessary to both protect the rights of casual workers and to ensure that such workers have no compulsion to risk their own well-being and that of others by going to work when ill. Similarly, we must ensure that all workers be granted special paid pandemic leave for self-isolation, quarantining and treatment if they may have COVID-19, or to care for ill family members. The government’s new scheme only allows for unpaid leave which for many low-paid workers will not only cause hardship but may push them to try sticking it out at work when they could be a risk to themselves and others.

At this time of economic crisis, temporary migrant workers and wage-working international students are the hardest hit section of the working class. Many have lost jobs or are casual workers who have suffered big cuts to the number of shifts that they get and, like most casual workers, the government’s much touted scheme to pay bosses of businesses that have lost significant revenue to retain workers will not help them at all. Moreover, unlike all other workers they will not get any Centrelink payments and international students are not even covered by Medicare. This is outrageous! These migrant workers face destitution and many now not only have no money to return to their home countries but cannot even do so due to travel restrictions. That is why it is absolutely urgent that we demand that all workers resident here get the same rights as people who are citizens. Full citizenship rights for everyone who is here! Moreover, in counter-position to the government’s JobKeeper scheme that will still allow hundreds of thousands of workers to lose their jobs while giving a windfall to many bosses, we must fight for jobs for all through preventing companies that have been making a profit over the years from cutting their workforce and by forcing still profitable companies to increase hiring at the expense of their profits.

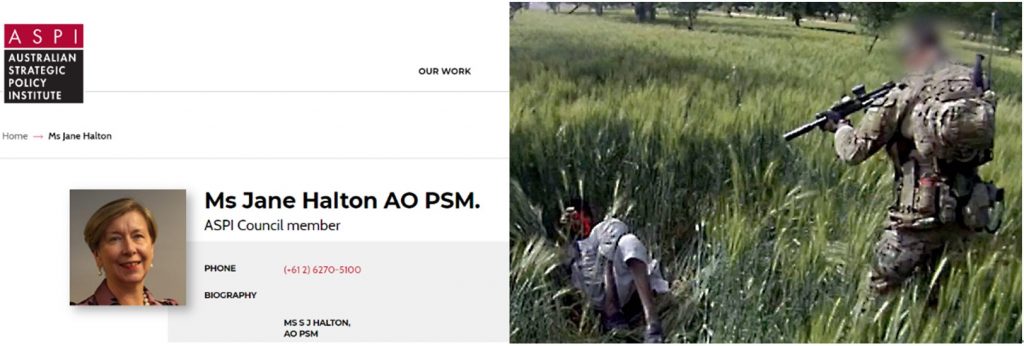

Such an agenda can only be won through working class-led struggle. Although, at this moment, it may even be from the point of view of the overall interests of the capitalist class partly rational to put the banks under state control in order to avert an economic collapse, the exploiting class will resist any demands for such measures, not least because such a nationalisation would immediately pose the question that if the capitalist owners cannot be trusted to run the banks themselves then why shouldn’t the banks and the rest of the economy be taken completely out of their hands and put into public ownership. As a crucial part of any working-class fightback the workers movement must champion the cause of all other sections of the oppressed. In particular the working class must support Aboriginal people’s struggle against racist state killings of black people in custody, a movement that has been injected with renewed energy in the wake of the mass anti-racist resistance struggles in the U.S.

Mass struggle at this time of pandemic is, of course, difficult. However, let’s not forget that the working class movement has had to struggle in the past – and often in the present too in not only openly capitalist dictatorships but to some degree in the so-called “democracies” as well – in difficult conditions where protests, strikes and leftist political activity have faced repression or even been outright outlawed. This time of virus-related restrictions is, of course, very different in that we ourselves uphold – and actually actively promote – genuine social-distancing measures. However, like in times of intense of police-state repression, it is still a matter of finding ways to overcome major obstacles. We certainly don’t need to come up with all the ways that we can have an impact here. Politically active working class people will themselves come up with suitable methods – the masses are very innovative and that has been proven over decades and decades of struggle.

State-Controlled Banks and COVID-19 Response: A Case Study

If anyone wants to see why we need to put the banks under state control they should look at how the finance sector works in the world’s most populous country – and Australia’s biggest trading partner – the Peoples Republic of China (PRC). In China all the major banks are nationalised. And that was part of why the PRC was so effectively able to respond to the COVID-19 threat. Although China was the place where the virus – whose exact origin remains unknown – first spread in a really big known way, the PRC was able to respond so effectively and quickly that today in China, and even in the city of Wuhan, the former centre of the outbreak, people are again socialising, starting to resume eating out at cafes and restaurants, travelling long distances on public transport, slowly returning to tourist sites, working at factories and other works sites and gradually returning to full school operations. More importantly, the PRC’s response has been so successful that per million residents, far less people have died from the virus in China than have died in wealthier countries that have had much, much more time to prepare for the virus spread. Thus, the number of deaths per resident as of July 18 is already 45% higher in Australia than in China, 133 times higher in the U.S. than in China and in Switzerland, the country famous for its free-wheeling, scantily regulated capitalist banks, the number of deaths per resident is already 71 times higher than in China.

It is important to see why the PRC has been able to respond so effectively to the virus threat. In particular let us see how having a nationalised banking sector made a difference. Crucially, as soon as it become apparent just how contagious and deadly the then newly discovered virus was, China’s banks started supplementing PRC government outlays to firms to boost production of – or in many cases to entirely switch over the output of their operations to produce – items crucial to the epidemic response. Such products included surgical masks, goggles and full protective suits for medical workers, face masks for the public, COVID-19 testing kits, ambulances, disinfectant and ventilators. Within two weeks, PRC banks had already lent out tens of billions of dollars in very low interest rate loans to support the production of these items. By March 13, the amount that the PRC’s state-controlled banks had lent out to contain the impact of the virus had grown to $330 billion!

Photo credit (photo on Right): Mitchell Woolnough

The production of pandemic relief goods – especially PPE (Personal Protective Equipment) for medical workers – is absolutely vital in the fight against this pandemic. Unfortunately, in the very early days of the outbreak in Wuhan, before it was realised just how contagious the virus was – and even what it was – and how crucial was the need for protective gear, many medical staff in Wuhan became infected with the virus and also spread it to other colleagues, and several of the infected staff later died. In late January, with a large number of ill people pouring into Wuhan hospitals the hospital system in Wuhan was obviously overwhelmed and there was a shortage of protective gear, medicine and equipment. However, before long, with PRC manufacturers, armed with cheap credit doled out at lightning speed by her nationalised banks, rapidly switching over to producing protective gear, all nurses, hospital cleaners and doctors in China were wearing full space-suit-style head-to-toe protective gear. As a result, not a single one of the more than 42,600 health workers who travelled from other parts of China to Hubei Province to aid the virus response became infected, let alone died from the disease. By contrast, the capitalist countries with their private, profit-driven banks have not been able to equip their health workers with PPE effectively. Capitalist banks resist any loans that do not guarantee them a sizable and secure return. Moreover, they would also take considerable time approving any loans made for epidemic response as they ponder and calculate what they can get out of lending large amounts to any particular project for manufacturing epidemic prevention materials. In Australia, any switching over of production to aid the pandemic response by manufacturers is happening way too little and way too late. Therefore, even though authorities in countries like the U.S., Australia and Italy have had the big advantage of knowing for several weeks, if not months, just how infectious the virus was before it spread widely in their own countries, they have not even been able to ensure adequate protective equipment for their health workers. In the U.S., many nurses have had to resort to wearing home-made “protective gear,” like garbage bags, as poor substitutes for personal protective equipment. In Italy, as of April 17, at least 159 medical workers had died from COVID-19. Apart from the personal tragedies here, the effects of health workers becoming infected is devastating for the overall pandemic response. It means that large numbers of medical staff are not able to contribute to the response effort as they languish in quarantine, while other doctors and nurses, before they are identified as having COVID-19, end up passing on the virus to other medical staff and to patients who have come in for non-COVID-19 illnesses. In Australia, the failure to be able to outfit all health workers with the head-to-toe PPE that China’s nurses, doctors and janitors are equipped with has meant that as of July 18 over 400 nurses, doctors and health workers in Victoria alone have been infected. The failure to provide adequate PPE for health and aged care workers is also a key reason for the deadly virus spreads in North-West Tasmanian hospitals and in the Christian-run nursing home in Sydney’s Outer West that took the lives of 30 people between them.

Build toward the Future Confiscation of Banks, Industry, Mines, Communications Infrastructure and Agricultural Land and their Transfer into Public Ownership

It is not only in responding to the direct virus threat that the PRC’s nationalised banks have come into their own. To avert mass layoffs and economic shocks during this pandemic, China’s banks have sacrificed profits by rolling over and extending loans to hard-hit firms and self-employed people and by lending large amounts of money at low interest rates to assist enterprises to re-start production with the curbing of the epidemic spread. In a similar way, the PRC’s nationalised banking sector played a crucial role in allowing China to sail through the late noughties Global Recession as they lent huge amounts of money to finance high-speed rail lines, water conservation projects, environmental projects and the massive construction of low-rent public housing.

Yet it is not just during a crisis that the advantages of the PRC’s state-controlled finance sector is apparent. These Chinese banks have been directed to ensure that their lending practices are in lockstep with the PRC’s “Homes Are For Living In, Not for Speculation” policy. Thus, they have provided much credit to support public housing construction. Moreover, very different to Australia’s profit-obsessed banks, China’s banks charge any family seeking a bank loan for buying a second home a much higher interest rate than they charge those buying their first home, while they don’t lend at all to anyone trying to buy a third home. More broadly, China’s state-controlled banks are directed to lend to projects that may not be very profitable for the banks but which are important for the society and for the people’s economic development. Thus, these banks have specially lent to research and development projects in areas that are important for that country’s future economic progress like nanotechnology, advanced materials, artificial intelligence, advanced electronic hardware, aircraft research etc. Meanwhile, given that the PRC state has identified environmental protection as one of its three principal tasks, alongside poverty alleviation and curbing financial risks, the banks have directed a significant part of their lending to projects aimed at curbing water and air pollution. In particular, by supporting renewable energy projects with credit, they have helped China to become the world leader in renewable energy, with more than three times the installed solar power capacity of any other country and more than twice the wind generation capacity of the next biggest wind power producer. However, the most crucial practice of the PRC’s nationalised banking sector is its support for the country’s poverty alleviation drive. Over the last several years, as part of the PRC’s drive to lift every resident out of extreme poverty by the end of 2020, China’s state banks have lent literally hundreds of billions of dollars to poverty alleviation projects in poorer parts of the country. Many of these projects involve renovation of shantytowns and upgrading of infrastructure in impoverished and remote parts of the country as well as supporting community-based aged care facilities provided for lower income residents. Crucially, the PRC’s state-controlled banks have also provided credit for the development of job-creating industries in poorer, rural parts of the country including food processing operations, agricultural co-operatives, rural tourism and renewable energy projects. Partly as a result of such support for her poverty alleviation drive from her nationalised finance sector, China remains on track to achieve her poverty alleviation target by the end of this year despite the impact of the COVID-19 pandemic.

It is important to be aware that the PRC’s banks are not just state-controlled, they are overwhelmingly also state-owned. Thus, each and every one of China’s big four commercial banks are state-owned. Indeed, even if we include all the medium-sized banks in China, we find that majority state-owned banks so dominate the PRC’s finance sector that there is really only one significant sized bank – China’s tenth largest bank – that can be considered to be truly privately-owned; and even in that one case state-owned companies have recently become its largest shareholders owning around a quarter of the bank. Moreover, in addition to her commercial banks, the PRC has three massive, 100% state-owned policy banks whose lending is completed devoted to projects that are deemed in society’s overall interest. Two of these policy banks in particular, the China Development Bank and the Agricultural Development Bank of China, whose combined assets would make them China’s second largest bank, have been at the forefront of lending to support China’s poverty alleviation drive and more recently for the pandemic response effort.

There is a notable difference between banks being merely state-controlled and being actually state-owned. For one, even if banks are state-controlled, if they remain privately-owned their wealthy owners will act as a constant pressure on the state pushing for the banks to be run largely according to the profit motive as opposed to according to social needs. Secondly, if banks remain only state-controlled their massive profits would still be flowing into the hands of their largely ultra-rich owners rather than into the public budget. Remember, last year, in a “bad” year for them, Australia’s big four banks alone leached $26 billion in profits. To be sure, if they became state-controlled their profits would drop somewhat as their lending and investment becomes partially re-directed away from areas that simply bring the highest return. Nevertheless, even if their profits were halved as a result of being placed under state control, that’s still $13 billion that could go into the public budget if these corporations were only brought into state ownership. How much badly needed public housing could we get with that?! Well, actually, we can calculate that. According to the government’s own figures (see Table 18A.43 in the appendix of Excel spreadsheets under Part G, Section 18 of the Report on Government Services 2020 in the Australian Government Productivity Commission website https://www.pc.gov.au/research/ongoing/report-on-government-services/2020/housing-and-homelessness/housing), the average annual cost of a public house unit, including the capital cost, is $39,714 per dwelling. So if we had even half the current profits extracted by the biggest banks in Australia go into the public coffers we could support an extra 327,340 public housing dwellings which would easily more than double the existing stock of public housing. That could really solve the problem of homelessness and make good strides towards addressing the extreme shortage of low-rent housing in Australia.

That is why what is finally needed is to confiscate all the banks, insurance corporations, superannuation companies, wealth management firms and securities businesses from their ultra-wealthy owners and bring them all into state-ownership. This should be accomplished without giving any compensation to the big shareholders. However, to avoid unnecessarily antagonising the middle class, the stock holdings of the numerous small shareholders who together own a tiny fraction of these corporations can be bought out. Since the superannuation firms will be confiscated too, workers won’t need to worry about losing their super when the banks get taken. They will still get their retirement funds from the now publicly owned providers and with less eaten in fees by billionaire finance sector bosses to boot. However, the retirement payment system will progressively be switched from one based on individual superannuation accounts to one based on a higher and equal pension for all.

Our agitational demand to put the banks under state control, that is to nationalise the banks, that we made in the headline of this article, is not in itself a call to confiscate the banks and put them into public ownership. Russian revolutionary leader Vladimir Lenin made a similar call some six weeks prior to the working class seizure of power in the October 1917 Russian Revolution. As Lenin explained:

It is absurd to control and regulate deliveries of grain, or the production and distribution of goods generally, without controlling and regulating bank operations….

The ownership of the capital wielded by and concentrated in the banks is certified by printed and written certificates called shares, bonds, bills, receipts, etc. Not a single one of these certificates would be invalidated or altered if the banks were nationalised, i.e. if all banks were amalgamated into a single state bank…. whoever owned fifteen million rubles would continue after the nationalisation of the banks to have fifteen million rubles in the form of shares, bonds, bills, commercial certificates and so on.

— V.I. Lenin, The Impending Catastrophe and How to Combat It, September 1917

Lenin’s Bolsheviks made the demand for the nationalisation of the banks in this period as an urgent measure to control economic life at a time when Russia’s masses were being struck down by mass unemployment, disorganised industry and terrible shortages of food and other staple items. However, the revolutionaries also understood that by showing the masses the need to take the control of the banks out of the hands of the capitalists they were thus leading working class people to the conclusion that they ultimately need to also take the ownership of the banks from the capitalists. Indeed, in the period after the October Revolution, the new workers government of Soviet Russia confiscated the banks along with the railways, industries and agricultural land and transferred them into public ownership.

Putting the banks under state control or even confiscating the finance sector, while a vital measure, does not solve all problems – not even the most urgent ones. So while we need state banks to lend to certain manufacturers to aid them to switch their operations to produce vitally needed pandemic relief goods, if the manufacturing bosses still can’t find a way to make a big profit out of those operations, even with low-interest loans, they are very unlikely to change over their factories; and if they do many would do it too slowly or only in a token way to gain positive publicity. So we need to have a perspective of confiscating not only the finance sector but also taking the key industries, the mines that produce the raw materials, transport and distribution means, power, communications and other infrastructure as well as construction out of the hands of the profit-driven capitalists and placing them into the collective hands of the people. In China it is not just their banks that are under state-ownership but all their key sectors. As a result when there was a need for firms to switch over their production to make pandemic relief goods, the relevant state-owned enterprises not only got access to cheap credit to assist them but were basically ordered to make the conversion. That is why you have all sorts of Chinese industries, seemingly unrelated to making protective and medical gear, contributing to China’s pandemic relief effort. For example, state-owned Shanghai Three Gun group, China’s biggest producer of underwear, is now producing more than one million masks per day.

What a society where public ownership plays the backbone role can do was seen most clearly in the way that the PRC built two large brand new hospitals from the ground up in less than two weeks when the number of people getting seriously ill from COVID-19 started surging in late January. The challenge in building these hospitals in Wuhan so quickly was especially steep given that these specialist infectious disease hospitals, unlike other hospitals, needed to have negative pressure wards to ensure that the air leaving wards with the infected patients is ejected safely rather than seeping out to potentially infect hospital workers and others. The first of these hospitals put into service, the 1,000 bed Huoshenshan (“Fire God Mountain”) Hospital was built in just 10 days. The second, the 1,600 bed Leishenshan (“Thunder God Mountain”) Hospital was put into service just days later. And it was thousands of workers organised through the PRC firms under public ownership that played the key role in pulling off these amazing feats. Financing for the project was provided both from the central government and by the 100% state-owned policy bank, the China Development Bank. The design of the hospital was performed by the CITIC General Institute of Architectural Design and Research, a subsidiary of the giant PRC public-owned conglomerate, CITIC. The actual construction of the hospitals was undertaken by the Third Engineering Bureau of state-owned China State Construction Engineering, the largest construction company in the world. Meanwhile, China State Grid organised 260 workers in around the clock shifts to ensure that the power connection was ready in time. Communications within the hospital and a stable 5G internet connection was achieved within 36 hours through a collaborative effort of China’s state-owned communication giants China Mobile, China Telecom, China Unicom and China Tower. Meanwhile, CT scanning equipment and X-rays were provided by Shanghai United Imaging, a high-tech firm jointly held by a range of PRC state-owned firms.

Right now the mass of working class people in Australia does not yet appreciate the need for the confiscation of the banks and industry from the capitalists and their transfer into public ownership. The very most politically advanced workers and leftist activists do understand that this is what is needed. However, ruling class propaganda has been able to tentatively convince the majority of working class people that private ownership of the economy should be “respected.” Nevertheless, right now there is widespread distrust of the banking system at the very same moment that many working class people are very worried about the pandemic, about whether they will have a job and about their ability to pay rent and buy essentials. That is why we today emphasise the call for the nationalisation of the banks as a slogan around which to mobilise united front struggle that will, on the one hand, demand this immediate measure necessary for both the COVID-19 response effort and to protect the masses from unemployment and poverty and that will, on the other hand, in the course of their struggle to win this demand, point working class people towards the ultimate need for the confiscation of the banks and all key sectors and their transferal into public ownership.

We Need a Workers State

If powerful working class struggle were able to force the capitalist government to nationalise the banks, the question then becomes posed: who would be administering this now state-run finance system? Sure, a finance system under state control would face more mass pressure to run its operations according to people’s interests than privately owned banks do. However, would you trust the anti-working class Morrison government or the desperate-to-not-scare-the-capitalists-Albanese led ALP to ensure that a state bank would actually serve the masses rather than the big end of town?

The problem is not simply the government but the bureaucracy. No matter the political stripe of who sits in ministers’ chairs and who wins elections, the fact is that the same layer of high-ranking state officials who have been allowing the finance sector corporations to fleece the public will still be the ones “regulating” them. The “regulator” of the finance sector, ASIC (Australian Securities and Investments Commission) has been so deferential to the finance industry bosses that even the limp Royal Commission criticised it for its “softly, softly approach” to illegal activity by the banks. However, ASIC is not going to fundamentally change. If you see who leads it, even now after getting a slap on the wrist from the Royal Commission, you will know why. ASIC’s leadership remains people with strong ties to the finance sector bosses and other corporate bigwigs. Thus ASIC chair, James Shipton, spent ten years as the managing director of various divisions of the Asia-Pacific office of American banking giant, Goldman Sachs. Of the six other commissioners who lead ASIC, one previously had senior roles in NAB and ANZ (and does anyone expect him to now go hard on them?!!), two had been top bosses of other finance services companies and one had been most recently CEO of the Myer Family Company.