As gold broke below the psychologically important level of $1,200 an ounce late in December of 2014, the mainstream financial media burst with headlines like this one from Marketwatch: “Gold’s Safe-Haven Role is Over.” The Nobel prize winning economist from the New York Times, Paul Krugman, penned a wicked missive on the ‘barbarous relic’ by invoking Keynes and the absurdity of miners going to “great lengths to dig cash out of the ground, even though unlimited amounts of cash could be created at essentially no cost with the printing press.”

The basis of a vibrant and dynamic society is an open and free marketplace where people ‘vote’ with their decisions on where to spend money, where to live, what to read, who to vote for, etc. In the United States, a good example of what occurs when decisions are centralized is healthcare and education — the key decisions are made outside the mainstream of the marketplace and the country ranks far below the rest of the developed world, even behind countries with considerably less economic wealth. As central planning and regulations remove potential players and solidify the positions of special interests, the quality of education and healthcare has plummeted.

So what does this have to do with the price of gold? Everything.

What is Money?

Gold is money. Federal Reserve Notes are not money on one important score; they are a poor long term store of value. One ounce of gold in 1938 was worth just about $35 and a new car was worth $860. If a new car dealer took the money from the sale of a new car in 1938, converted it to gold and gave that gold to his new born son, when the boy turned 75 in 2013 he could have bought a brand new Toyota Camry with the gold his father had given him. If instead, the father had given him the cash, he could have gone out and bought himself a fancy new bicycle with the dollars he’d held on to for 75 years.

If the old man, feeling flush, tossed in an extra ounce of the ‘barbarous relic’ for gas in 1938 his son could have bought about 350 gallons of gas for the ounce of gold. If the kiddo had held on to the gas money in the form of gold, he could have, in 2013, bought almost the exact amount, 360 gallons. But if the youngster had made the mistake of converting his ounce of gold into dollars, he could have, in 2013, bought a good bottle of Spanish wine with the Federal Reserve Notes he received in 1938 for his ounce of gold.

.

Money is a means of exchange, AND a store of value. The dollar is a great means of exchange but it’s a pitiful store of value.

In essence, money is work. If someone wants to sell 1,000 kilos of wild salmon for $10,000 he might find a few buyers who, if they wanted to proceed, would ask about delivery. If the seller pointed toward the cold waters off the Alaskan coast and indicated that the fish were out there swimming around, he wouldn’t have any buyers at any price. When someone pays for fish, they are not paying money for the fish, they are paying money for the work involved in finding them, catching them, and transporting them to market. Money is a means of exchange- the fisherman exchanges his work (the fish) for money and he uses the money to maintain the value of his work and later exchange it for the work of others. That is money for the working man.

The Sucker, the Conman, and the Shill

Imagine the fisherman decides he needs a new boat and wants to finance the entire purchase price. He will go to his local bank and, if approved, will be given the funds to purchase the boat in exchange for signing a promissory note for the amount and terms of the loan.

When the fisherman signed the promissory note, he assumed that other fishermen, or their equivalents in productive society, worked, earned money, deposited that money in a bank to earn interest and that’s the interest he was going to pay on his boat loan, plus the margin for the bank. The interest rate he was paying seemed reasonable, 7%. The guy who deposited the money needs a return, and so does the bank. In fact, it seemed cheap to him. He probably wouldn’t continue fishing if the best he could do was make what the bank or the depositor made, say about half of his interest rate, 3.5%. For that, he would sell everything and buy a ten year bond that paid close to 3% and call it a day. But he’s not a banker and he assumes they’re making money some other way.

The banker is thrilled. He did take some deposits and put them in reserve (about 10% of the loan amount) and he will be paid interest (.25%) on that amount by the Fed. Then he created, out of thin air, the entire loan amount to give to the fisherman. The money he gave the fisherman never existed before the fisherman signed the promissory note. The banker is making more than 70% on the money he has left in reserve, for which is also earning interest. Worst case, if the fisherman goes belly up, the banker will sell the boat. He can’t lose much.

The PhD Nobel Laureate, writing for a one of the world’s great newspapers, never a word he speaks of this, for if he did, only for Zero Hedge would he write and not a penny would he see for his poetic prose. So instead he writes about Democrats and Republicans and higher taxes on the fisherman to pay for the bigger deficits he is so fond of. More deficits, more debt, he exclaims. Just print the stuff like it’s going out of style and we’ll all be living high on the hog.

The fact is, only the fisherman actually does something worthwhile for society, while the banker stuffs his pockets and the PhD stuffs his ego while filling the masses with fantasies.

So what does this have to do with gold going below $960? Everything.

The Script

To survive as a human being in the United States, as well as in most corners of this world, one needs money. Money to put a roof over one’s head, money to buy food, money to heat one’s house, money to put a shirt on one’s back. The banker’s script says that fiat money (dollars, yen, euros, etc.) is real money, the same as gold. Money is work, and gold stores the value of work. Fiat money is a claim on future work- it’s not work itself.

To survive as a human being in the United States, as well as in most corners of this world, one needs money. Money to put a roof over one’s head, money to buy food, money to heat one’s house, money to put a shirt on one’s back. The banker’s script says that fiat money (dollars, yen, euros, etc.) is real money, the same as gold. Money is work, and gold stores the value of work. Fiat money is a claim on future work- it’s not work itself.

What banks do is the equivalent of allowing people to become indentured servants, signing away their futures for a stack of instantly made Federal Reserve Notes, and they get their hooks in early. The average college graduate in 2012 had just over $20,000 in student loan debt on graduation day as well as additional credit card debt. The banker’s ability to create money out of nothing and lend it to kids is a good example of how they have completely demolished any semblance of democracy in America. Who in their right mind would loan a kid $20,000 for a college education if the money they lent was earned through work? Would we pay billions to the NSA to spy on us, or trillions to fight imperial proxy wars all over the world if we had to pay for them with work (gold)?

Of course we wouldn’t. If the money that was loaned to governments, businesses and individuals was real, much more critical thinking would be involved in its allocation and the cumulative votes of investors would render practical results, instead Twitter is valued at over $30 billion. But when the Fed is pumping trillions into markets, who is thinking about risk? If people actually decided on public policy through having to pay for those polices through work, the world would look much different than it does today. When money is created by the trillions out of nothing and simply laid as claim on the future work of the populace, then the only ones deciding on those policies are the money masters who control the printing presses.

If gold were used as the basis of our money, the only way to make more of it would be to dig it out of the ground and that takes work, something bankers and shills are quite averse too. To loan money they would first have to either work and earn it, or make a spread on what they paid in interest and what they earned on loans, becoming intermediaries. Neither variant is to their liking as they much prefer to print it out of thin air, loan it out and keep the interest. The now infamous 1% are dependent on this model of money creation and when their ponzi scheme collapsed in 2008, they turned on the presses overtime and made it all back and more in a few short years.

Gold is incredibly democratic in that there is no machine to print it. But there is paper gold, which the bankers have leveraged about a 100 times and with which they can drive the price of gold wherever they want with their fiat money. The script says that their money is real- the new and improved version of the outdated gold. Gold is the enemy of fiat money because its intrinsic scarcity and universally accepted value is a constant reminder of the banker’s ponzi scheme.

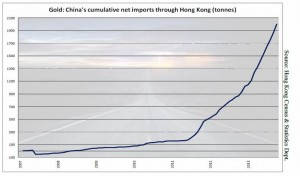

In April of 2011 gold hit a record high of $1,923 an ounce. Come hell or high-water, the banksters want to announce in the corporate media they own, that once and for all the shiny stuff has been deemed a relic, nice for jewelry but wholly useless as money. To do this they will drive the price below $960 an ounce, halving its price in dollars in about three years. It doesn’t take much to imagine the headlines, “Is Gold a Worthless Investment?” etc. But Dr. Krugman would say these are the fantasies of conspiratorial gold nuts. Really Dr. Krugman?

On April 11, 2013 gold closed at $1,562 an ounce. On April 12 someone sold 400 tons of gold, 300 of which was sold in just 30 minutes, driving the price of gold down below $1,500 an ounce, crashing through important technical levels and for many, marking the end to gold’s bull run which began in 2000. How much is 400 tons of gold? It’s about 15% of all the gold mined in 2011 or 0.25% of all the gold ever mined in the history of man, worth about $20 billion dollars at the time. This was obviously not done by someone who owned gold because there would be no reason to drive the price down so dramatically if someone wanted to exit a position. This was a naked short, done by someone with deep pockets to make a dramatic, headline catching move in the gold market. Not surprisingly, Dr. Krugman wasted no time chiming in and on April 15, 2013 he wrote of gold bugs, “Maybe, just maybe, the gold crash will finally bring intellectual capitulation. But I wouldn’t bet on it.”That’s very interesting coming from a Nobel prize winner [There is no Nobel prize in economics — DV Ed] who doesn’t even understand the basics of money creation, as was clearly shown in his debate with economist Steve Keen.

Gold is much more than an investment, it’s the backbone of liberty. Without it we will be led by the banksters and their shills down the merry way of slavery, plutocracy and totalitarianism.

It’s in the script.